Vancouver, British Columbia, December 7, 2022 – Emergent Metals Corp. (TSXV:EMR, OTC:EGMCF, FRA:EML, BSE:EML) (“Emergent” or the “Company”) announces it has completed ten diamond core drill holes totaling 2,963 meters as a first phase (“Phase 1”) of a drilling program (the “Program”) at its Casa South Property, Abitibi Region, Quebec (“Casa South” or the “Property”). The Company has also completed modelling and interpretation of 197 historic reverse circulation (“RC”) drill holes done to sample glacial till in the 1980’s by Overburden Drilling Management (“ODM”) in 1989. This analysis has identified 14 additional drill targets for future exploration.

Phase 1 drilling was completed near the northern Property boundary, adjacent to Hecla Mining Company’s (“Hecla”)(NYSE:HL) Casa Berardi Mine. Results, in conjunction with diamond core drilling completed by Emergent in 2019, indicate the presence of anomalous gold mineralization in the Kama Trend, a seven kilometer long by two kilometer wide east-west trending structure paralleling the Casa Berardi Deformation Corridor to the north where the Casa Berardi Mine is located. Note that the proximity of Casa South to Casa Berardi Mine does not guarantee exploration success on the Casa South Property and no mineral resources or reserves have yet been delineated on the Casa South Property.

David Watkinson, President and CEO of Emergent stated, “Casa South is a large property with multiple exploration targets, including both gold and base metals. The Company plans to conduct additional drilling programs to explore the potential of the Property and the Phase 1 drilling was the first of several phases we plan to conduct over the next several years as part of our exploration strategy for the Property. The presence of anomalous gold mineralization in the Kama Trend is encouraging.”

Results of the Phase 1 Drill Program

On September 1, 2021, Emergent announced it had received the results of a UAV-MAGTM survey (the “Mag Survey”) completed by Pioneer Exploration Consultants Ltd. (“Pioneer”) and Generic Geo Inc (“Generic Geo”) over the Property. The Mag Survey covered the majority of the 114 square kilometer property. A Preliminary Structural Interpretation of the Casa South Area of Influence, Quebec Canada (the “Interpretation”) was subsequently completed by Geokincern Limited (“Geokincern”) looking at geology, geophysical data from the Mag Survey, and high-resolution topographic data from NASA’s Suttle Radar Topography Mission, and satellite imagery. The Interpretation identified structures including folds, faults and shears, dykes, and magnetic fabrics. Geokincern’s Interpretation identified 20 geophysical exploration targets (“G1-G20”) on the Property and ranked them for priority. Eight targets were identified associated with coincident soil anomalies and 12 targets were identified associated with structural and aeromagnetic features as secondary and tertiary targets.

The Program, designed with direction from Mercator Geological Services (“Mercator”), was developed to test 8 of the 20 targets generated by Geokincern with diamond core drilling. A total of 16,175 meters of diamond drilling was permitted at 48 drill sites. Phase 1 of the Program tested five of the 20 Geokincern sites. (G1, G2, G3, G4, and G7). The Program is being broken up into discrete phases to allow for winter drilling and for adjustment to the Program based on exploration results at the end of each phase.

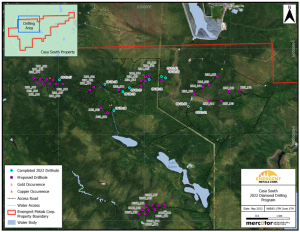

The 10 NQ sized diamond drill holes completed totaled 2,963 meters drilled. Locations of the 48 permitted holes are shown below, as well as the 10 completed diamond drill holes in cyan color. The property boundary with Casa Berardi Mine is shown in red.

Figure 1: Casa South Drill Hole Locations

Table 1 below contains a summary of the hole numbers, locations, elevation, azimuth, dip, and depth for Phase 1 drilling. Table 2 contains drill assay results by hole number for Phase 1 drilling.

Table 1: Casa South Phase 1 Drill Program Information

| Hole ID | Northing

(m) |

Easting

(m) |

Elevation (m) | Azimuth

(degrees) |

Dip

(degrees) |

Depth

(m) |

| CS-22-10 | 5488652.25 | 627025.5 | 278.2 | 335 | 45 | 351 |

| CS-22-11 | 5488606 | 627321 | 279 | 335 | 45 | 300 |

| CS-22-12 | 5489348 | 626401 | 280 | 0 | 50 | 395 |

| CS-22-13 | 5489319 | 626497 | 278.9 | 0 | 50 | 300 |

| CS-22-14 | 5489279 | 626116 | 283 | 0 | 45 | 324 |

| CS-22-15 | 5488997 | 625502 | 287.7 | 0 | 45 | 312 |

| CS-22-16 | 5489168 | 625082 | 288 | 320 | 45 | 300 |

| CS-22-17 | 5489274 | 624025 | 279 | 0 | 45 | 150 |

| CS-22-18 | 5488556 | 625293 | 283 | 0 | 45 | 300 |

| CS-22-19 | 5489088 | 625654 | 285 | 0 | 45 | 231 |

Table 2: Assay Highlights from Casa South Phase 1 Drill Program

Intervals Greater Than or Equal to 0.1 g/t Au

| Name | From (m) | To

(m) |

Length* (m) | Au

(g/t) |

As

(ppm) |

Lithology |

|

CS-22-12 |

157.10 | 159.00 | 1.30 | 0.242 | 4,488 | Int. Volcanics |

| and | 164.70 | 165.00 | 0.30 | 0.274 | 5,360 | Int. Volcanics |

| and | 246.40 | 250.30 | 3.90 | 0.167 | 8,130** | Int. Volcanics |

| and | 264.00 | 264.70 | 0.70 | 0.160 | 5,120 | Int. Volcanics |

| and | 269.50 | 270.08 | 1.30 | 0.310 | 4,290 | Int. Volcanics |

|

including |

270.60 | 270.80 | 0.2 | 1.515 | 1,765 | Int. Volcanics |

|

and |

279.70 | 282.00 | 2.30 | 0.155 | 5,001** | Int. Volcanics |

|

CS-22-13 |

243.00 | 244.00 | 1.00 | 0.174 | 7,530 | Int. Volcanics |

|

and |

254.00 | 257.00 | 3.00 | 0.121 | 6,547 | Int. Volcanics |

|

CS-22-14 |

97.50 | 99.00 | 1.50 | 0.123 | 3,860 | Int. Volcanics |

|

and |

101.20 | 101.85 | 0.65 | 0.193 | 219 | Siltstone

|

| and | 109.50 | 111.00 | 1.50 | 0.109 | 2,630 | Int. Volcanics |

| and | 123.00 | 124.50 | 1.50 | 0.104 | 5,370 | Int. Volcanics |

| and | 168.00 | 171.00 | 3.00 | 0.208 | 1,600 | Int. Volcanics |

*True widths unknown. some composited intervals may contain individual assays less than 0.1 g/t Au for continuity.

**Calculated average arsenic level contains some individual assays of 10,000 ppm, the maximum detection limit used by the assay lab, hence actual arsenic levels in this interval may be higher than shown.

Phase 1 of the Program delivered anomalous gold intercepts with the highest returned assay value of 1.515 g/t Au over 0.2 meters. This interval also included 43.1 ppm Ag, 2,530 ppm Cu, and 472 ppm Zn. The longest mineralized intercept, based on a cut-off grade of 0.1 g/t gold was 0.167 g/t gold over 3.9 meters. Elevated arsenic values, up to the upper limit (10,000 ppm), were observed in some intervals, typically associated with elevated gold values, showed a relationship between gold and arsenopyrite. Less spatially related, anomalous values of copper, zinc, cobalt, and nickel were returned.

Results of the Analysis of Historic Glacial Till Drilling and Sampling

Sampling of glacial till was used historically and helped to lead to the discovery of the Casa Berardi Mine, to the north of Casa South. Reverse circulation drilling was done in the glacial till and typically a few meters into bedrock. Samples were taken and screened to collect heavy minerals including gold, arsenic, copper, zinc, and silver. The lithologic units over various till layers were also determined. The goal was to identify soil anomalies in the till that could potentially be traced back to mineralized bedrock targets, based on till movement over time.

Mercator computerized and remodeled historic till sampling data from paper cross sections using Leapfrog Geo software. Data was taken from an Assessment Report completed by ODM for Cambior Inc. in 1989 (GM 49285). From this analysis, Mercator has identified 14 soil anomalies (“M1-14”) for follow up. Some of these 14 soil anomalies overlap or are near the 20 structural and aeromagnetic targets identified by Geokincern in 2021. Mercator has made recommendations for prioritization and further follow up on the remaining 15 Geokincern exploration targets and the new 14 till anomaly targets.

QAQC Program

Technominex Inc. (“Technominex”) was contracted by Mercator for core sampling/cutting services. Logging, sampling, and assaying procedures were completed by Mercator and Technominex personnel as per Emergent’s QA/QC protocols and full chain of custody was maintained from the drill site to the core shack, and subsequently from the core shack to Technominex and ALS facilities.

Drill core was descriptively logged on site, aligned, marked for sampling, and shipped to Technominex facility in Rouyn-Noranda to be split in half longitudinally using a diamond saw blade. Samples consisted of half NQ-size diamond drill core (47.6 mm diameter core) and were predominantly collected using nominal 1.0 and 1.5 m, core lengths, except where specific geologic parameters required a smaller interval to be sampled. One-half of the core was preserved in core boxes for future reference.

As part of Emergent’s QA/QC protocols, samples comprising the other half of the core were bagged, tagged, sealed and shipped to ALS Canada Ltd. (ALS) in Rouyn-Noranda, Quebec. Sample preparations were completed at ALS’s Rouyn-Noranda facility, while analytical determinations were completed at ALS’s laboratory facility in North Vancouver, BC.

ALS is an independent commercial analytical firm with operations throughout the world and is ISO 9001: 2015 and ISO/IEC 17025:2017 certified. Sample preparation included crushing each sample to ≥70% passing 2 mm, and a 250 g Riffle split being pulverized to ≥85% passing 75 microns. Mercator submitted blanks (one per 20 samples) and certified standards (one per 20 samples). The standards were delivered in prepackaged packets and supplied from Technominex’s facility. Samples analyzed by ALS were assayed using their Au-AA23 Fire Assay, Atomic Absorption Spectroscopy procedure as well as using their ME-ICP61 (Four acid digestion) method, using ICP-AES analysis. Full assay certificates (including internal laboratory QA/QC samples) and descriptions of analytical and preparation procedures were obtained.

Qualified Person

Kevin-Dane MacRae, P.Geo., a professional geologist registered with L’Ordre des géologues du Québec and a qualified person under NI 43-101 has reviewed and approved the content of this press release.

About Emergent

Emergent is a gold and base metal exploration company focused on Nevada and Quebec. The Company’s strategy is to look for quality acquisitions, add value to these assets through exploration, and monetize them through sale, joint ventures, option, royalty, and other transactions to create value for our shareholders (acquisition and divestiture (A&D) business model).

In Nevada, Emergent’s Golden Arrow Property, the core asset of the Company, is an advanced stage gold and silver property with a well-defined measured and indicated resource. New York Canyon is a base metal property subject to an Earn-in with Option to Joint Venture Agreement with Kennecott Exploration, a subsidiary of Rio Tinto Plc (NYSE:RIO). The Mindora Property is a gold, silver, and base metal property located twelve miles from New York Canyon. Buckskin Rawhide East is a gold and silver property leased to Rawhide Mining LLC, operators of the adjacent Rawhide Mine.

In Quebec, the Casa South Property, is an early-stage gold property adjacent to Hecla Mining Corporation’s (NYSE:HL) operating Casa Berardi Mine. The Trecesson Property is located about 50 km north of the Val d’Or mining camp. Emergent has a 1% NSR in the Troilus North Property, part of the Troilus Mine Property being explored by Troilus Gold Corporation (TSX:TLG). Emergent also has a 1% NSR in the East-West Property, owned by O3 Mining Corporation (TSX:OIII) and adjacent to their Marban Property.

Note that the location of Emergent’s properties adjacent to producing or past producing mines does not guarantee exploration success at Emergent’s properties or that mineral resources or reserves will be delineated. For more information on the Company, investors should review the Company’s website at www.emergentmining.com or view the Company’s filings available at www.sedar.com.

On behalf of the Board of Directors

David G. Watkinson, P.Eng.

President & CEO

For Further Information Please Contact:

David G. Watkinson, P.Eng.

Tel: 530-271-0679 Ext 101

Email: [email protected]

Neither TSX Venture Exchange nor its Regulation Services Provider (as the term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note on Forward-Looking Statements

Certain statements made and information contained herein may constitute “forward looking information” and “forward looking statements” within the meaning of applicable Canadian and United States securities legislation. These statements and information are based on facts currently available to the Company and there is no assurance that actual results will meet management’s expectations. Forward-looking statements and information may be identified by such terms as “anticipates”, “believes”, “targets”, “estimates”, “plans”, “expects”, “may”, “will”, “could” or “would”. Forward-looking statements and information contained herein are based on certain factors and assumptions regarding, among other things, the estimation of mineral resources and reserves, the realization of resource and reserve estimates, metal prices, taxation, the estimation, timing and amount of future exploration and development, capital and operating costs, the availability of financing, the receipt of regulatory approvals, environmental risks, title disputes and other matters. While the Company considers its assumptions to be reasonable as of the date hereof, forward-looking statements and information are not guarantees of future performance and readers should not place undue importance on such statements as actual events and results may differ materially from those described herein. The Company does not undertake to update any forward-looking statements or information except as may be required by applicable securities laws. The Company’s Canadian public disclosure filings may be accessed via www.sedar.com and readers are urged to review these materials, including any technical reports filed with respect to the Company’s mineral properties.