PROPERTY OVERVIEW

| LOCATION | 20 miles southeast of Hawthorne, NV |

| TYPE OF PROJECT | Early stage exploration |

| NUMBER OF CLAIMS | 147 unpatented claims |

| PROPERTY SIZE | 2,940 ac |

| OWNERSHIP | 135 claims owned by Emgold

12 claims under purchase agreement with Nevada Sunrise LLC |

| PROPERTY STATUS | Available for sale or option |

| UNDERLYING ROYALTIES | US $20,000 advance minimum royalty to BL Exploration on 135 unpatented claims and 2% Net Smelter Royalty, half of which can be acquired for US$200,000 prior to the 5th year of the Agreement or US$500,000 between the 5th and 9th anniversary of the Agreement |

| EXPLORATION COMPLETED |

|

| KEY EXPLORATION TARGETS |

|

| NI 43-101 TECHNICAL REPORT | None completed to date |

| MINERAL RESOURCES | None defined to date |

| EXPLORATION HIGHLIGHTS |

Historic work by others shows a conceptual higher grade target of 30,000 to 60,000 oz. @ 0.05-0.1 opt AuEq. A larger bulk disseminated target was also delineated with historic grades ranging from 0.02-0.04 opt Au. Historic drilling also encountered Mo mineralization below the Au/Ag and potential exists for a Mo/Cu porphyry system at depth. |

INTRODUCTION

On May 21, 2018, Emgold announced it had signed a Letter of Intent with Nevada Sunrise LLC, a private Nevada company, giving it the right to purchase 12 unpatented mining (the “NS Claims”). The Company has also signed a separate Letter of Intent with BL Exploration LLC, also a private Nevada company, giving it the right to purchase 18 unpatented mining claims (the “BL Claims”). On December 17, 2020, Emgold announced it has staked 117 additional unpatented claims at Mindora. Together, the 147 unpatented mining claims make up the Mindora Property (the “Property”). The Property is an early stage gold, silver, and base metal exploration property that was explored in the 1980’s and 1990’s. The Property hosts near surface gold and silver mineralization, and deeper molybdenum porphyry mineralization.

Examples of significant intercepts from historic drilling on the Property include:

- 105 ft. (32.0 m) of 0.057 opt (1.94 gpt) gold and 3.552 opt (121.78 gpt) silver in hole #7, representing a 0.098 opt (3.36 gpt) AuEq grade from a hole depth of 0 to 105 ft. (0 to 32.0 m), with true width of intercept unknown (AuEq grade based on US$1,300 per oz. gold price and US$15 per oz. silver price, with no adjustment for recovery); and

- Hole No. 162 with 295 ft. (90 m) of 0.59% Mo from a hole depth of 175 to 470 feet, with true width of intercept unknown.

The exploration targets at Mindora include:

- A near surface higher grade gold and silver target (possible size of 30,000-50,000 AuEq ounces. at >0.75 AuEq opt) that may have potential to be mined by open pit methods with offsite processing;

- A lower grade gold-silver target (possible size of 300,000-500,000 AuEq ounces. >0.03 opt AuEQ) that represents a larger bulk disseminated deposit, similar to the nearby historic Santa Fe Mine, that has potential to be mined using open pit methods with on-site processing; and

- Deeper molybdenum and copper targets that would have potential for open pit or underground mining with onsite processing.

Note that there are currently no mineral resources or mining reserves yet defined at Mindora that meet NI 43-101 Standards for Disclosure or CIM Standards and these are targets only. Additional exploration is needed to develop resources and ultimately mineral reserves.

Mindora Property – Looking East

LOCATION & OWNERSHIP

The Property is a gold, silver, and base metal property located 20 miles southeast of Hawthorne, in the Garfield Hills, Mineral County, Nevada.Emgold signed two Letters of Intent to consolidate 30 contiguous unpatented mining claims and subsequently staked 117 additional unpatented claims, for a total of 147 unpatented claims that now make up the Property. The Property has regional synergy with Emergent's other properties in the Walker Lane structural trend in western Nevada and is near Emergent's New York Canyon Property, located about 12 miles away.

Mindora Property

Location Map

Terms of the Nevada Sunrise LLC Transaction

Subject to a Definitive Agreement dated June 15, 2019 and Amendment No. 1 to this Agreement dated December 23, 2020, Emgold has agreed to purchase a 100 percent interest in the 12 unpatented mining claims, the NS Claims, from Nevada Sunrise LLC, under the following terms:

- US$25,000 on or before December 31, 2019 (paid);

- US$25,000 on or before February 29, 2020 (paid); and

- US$25,000 per year on the anniversary date of the closing for a period of four years, for a total purchase price of US$150,000.

Terms of the BL Exploration LLC Transaction

Subject to a Definitive Agreement dated June 15, 2019 and Amendment No. 1 to this Agreement dated December 23, 2020, Emgold has purchased a 100 percent interest in 18 unpatented mining from BL Exploration LLC for US$50,000. The BL Claims will be subject to a US$20,000 per year advance royalty.

Emgold will assign a 2% NSR royalty to BL Exploration on the claims. Emgold will have the option of acquiring one-half of the 2% NSR for US$200,000 on or before the fifth anniversary of the closing of the transaction. Should Emgold not exercise this option, it will have a second option of acquiring ½ of the 2% NSR for US$500,000 after the fifth anniversary and before the ninth anniversary of the closing of the transaction.

GEOLOGY & MINERALIZATION

Limestone and intermediate volcanic rocks of the Triassic Luning Formation underlie the east and central portions of the Property. Quartz rhyolite and quartz latite dikes and sills, and altered granodiorite, intrude the meta-sedimentary and metavolcanic rocks. Late Tertiary volcanic rocks and overburden cover the western portion of the Property.

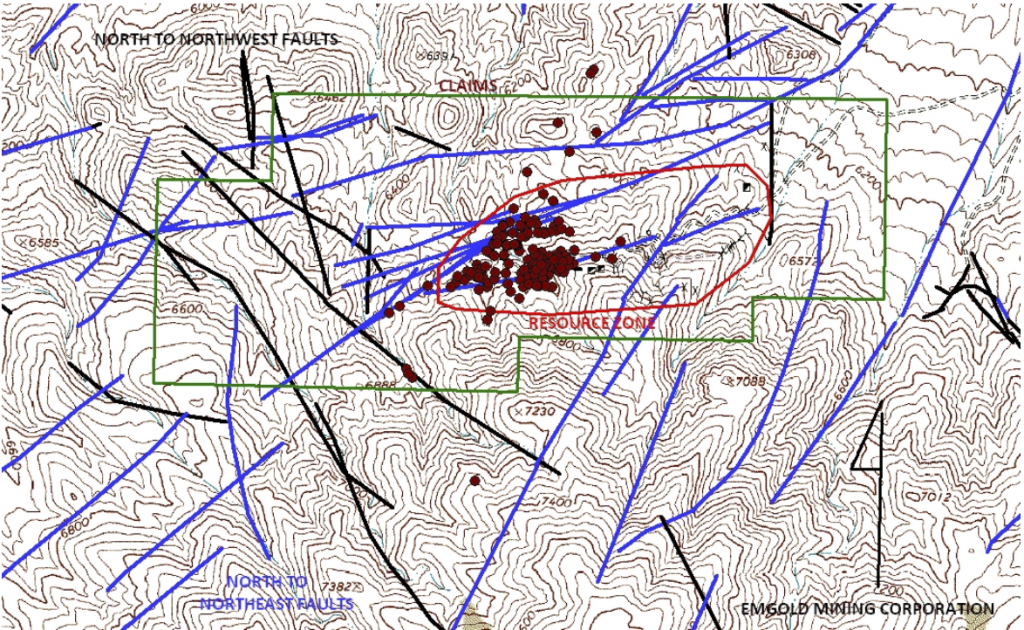

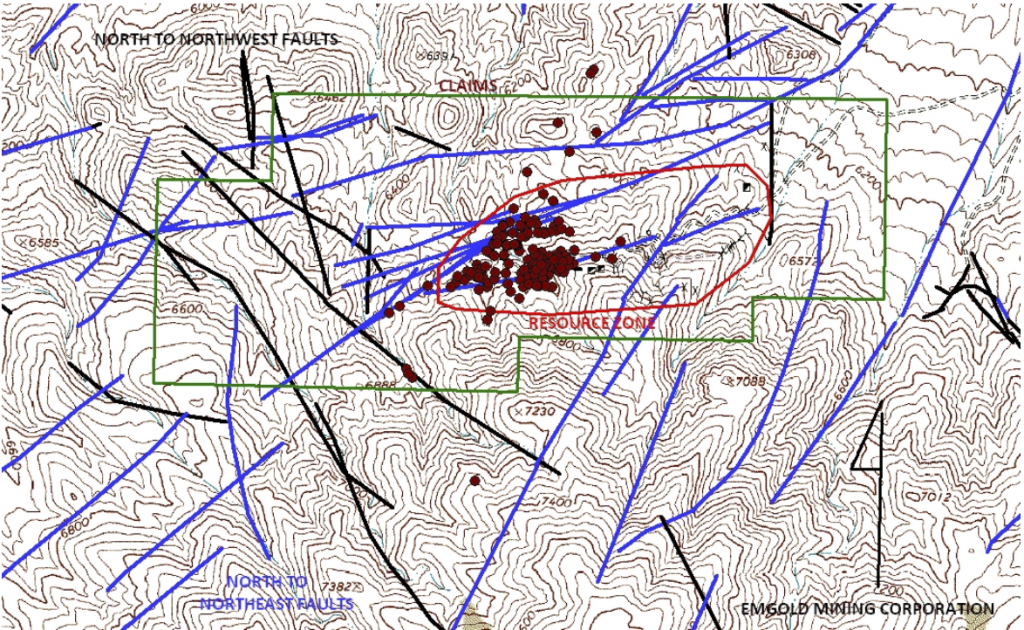

The gold-silver zone is an epithermal, carbonate-hosted, structurally controlled deposit in the Luning Limestone Formation. Mineralization is primarily situated along two northeast-trending fault zones, known as the Mindora lineament and the Santa Fe lineament. The gold-silver mineralization appears to be in pods of highly sheared, shattered and altered limestone. Many of the shallow holes testing near-surface gold-silver mineralization intercepted and ended in an extensive molybdenum stockwork system. The molybdenum is related to quartz latite and quartz porphyry dikes. The extent of the molybdenum system is not known. There is also evidence of copper skarn and copper porphyry mineralization on the Property from surface sampling, but no drilling has been done to test these targets. The dominant structures are northeast trending faults and secondary structures are northwest trending Walker Lane related faults.

Mindora Property

Claim Map, Drill Hole Locations, Structures, and Mineralized Zone (no scale)

EXPLORATION

The Property was discovered and worked in the late 1800’s. In the 1920’s with a limited amount of production came from a series of rich, silver-bearing veins. During the period 1946-1948, an estimated 10,000 tons of direct-shipping ore was mined from the Property at unknown grade.

In the 1970’s, geologists recognized the epithermal nature of mineralization, and similarities to the nearby Santa Fe deposit and other carbonate-rich sediment-hosted gold deposits in Nevada. The Santa Fe deposit was discovered in the late 1970’s and mined by Corona Gold in the late 1980’s and early 1990’s. Historic production estimated from Santa Fe Mine is 345,499 ounces of gold and 710,629 ounces of silver between 1989 and 1995 (source: The Nevada Mineral Industry, Special Publication MI-2017, Nevada Bureau of Mines and Geology). Note that the vicinity of the Property to a past producing mine is not necessarily indicative of the mineralization that may be hosted at Property. The historic Santa Fe Gold Mine is now owned by Victoria Gold Corporation (TSX:V: VIT) (“Victoria Gold”) and is in a reclamation phase.

Several companies staked the Property during this period, did limited sampling and geophysics, and then dropped their claims. Hawthorne Gold Corporation acquired the Property in 1979, and in the following year, brought in E & B Exploration Inc. as a joint-venture partner and operator. E & B completed programs of rock-chip sampling and trench sampling, surface and underground mapping, geophysical surveys, and drilled approximately 31,425 ft. (9,578 m) in 134 holes (including a water-well and two diamond core holes). E & B’s work developed four known mineralized zones.

Eureka Resources, Inc. acquired E & B’s interest in 1983. Eureka conducted IP, magnetic and VLF electromagnetic surveys, soil and rock-chip sampling and drilled an additional approximately 11,441 ft. (3,487 m) in 40 holes. In 1988, Eureka commissioned metallurgical studies and a detailed review by Kilborn Engineering with the goal of developing a small open pit gold mine.

Historic exploration resulted in the discovery of four separate mineralized zones. The grades of these zones ranged from 0.022 to 0.041 opt gold, and 0.88 to 2.08 opt silver. One goal of Emergent's exploration will be to combine these zones into one or two larger zones with infill drilling.

Eureka failed to file assessment work on the claims in 2001 and Nevada Sunrise LLC and BL Exploration staked the Property in 2001 and 2003, resulting in the current land package of the NS and BL Claims, respectively. Little exploration work has been done on the property since the last drilling program, completed in 1995.

Total drilling on the Property is about 42,836 ft., mostly in vertical holes in the range of 200-300 ft. Average depth is 250 ft. and maximum drilling depth of 700 ft. (214 m).

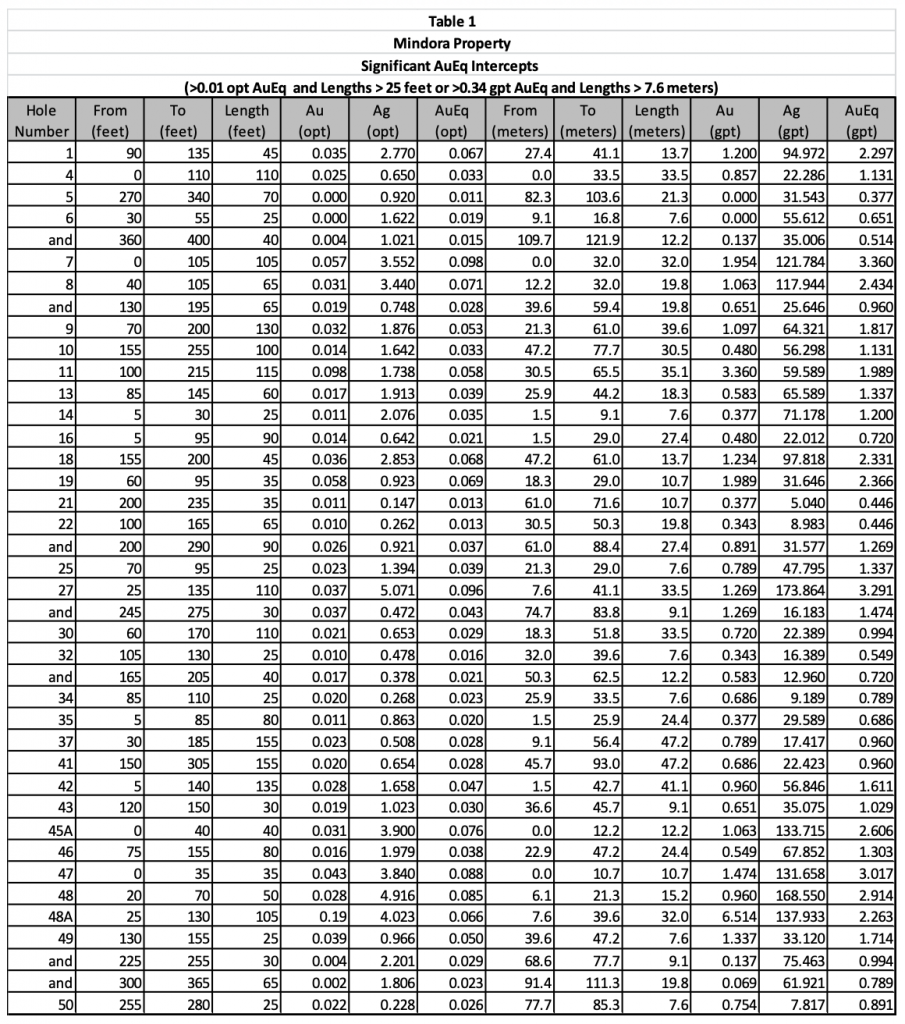

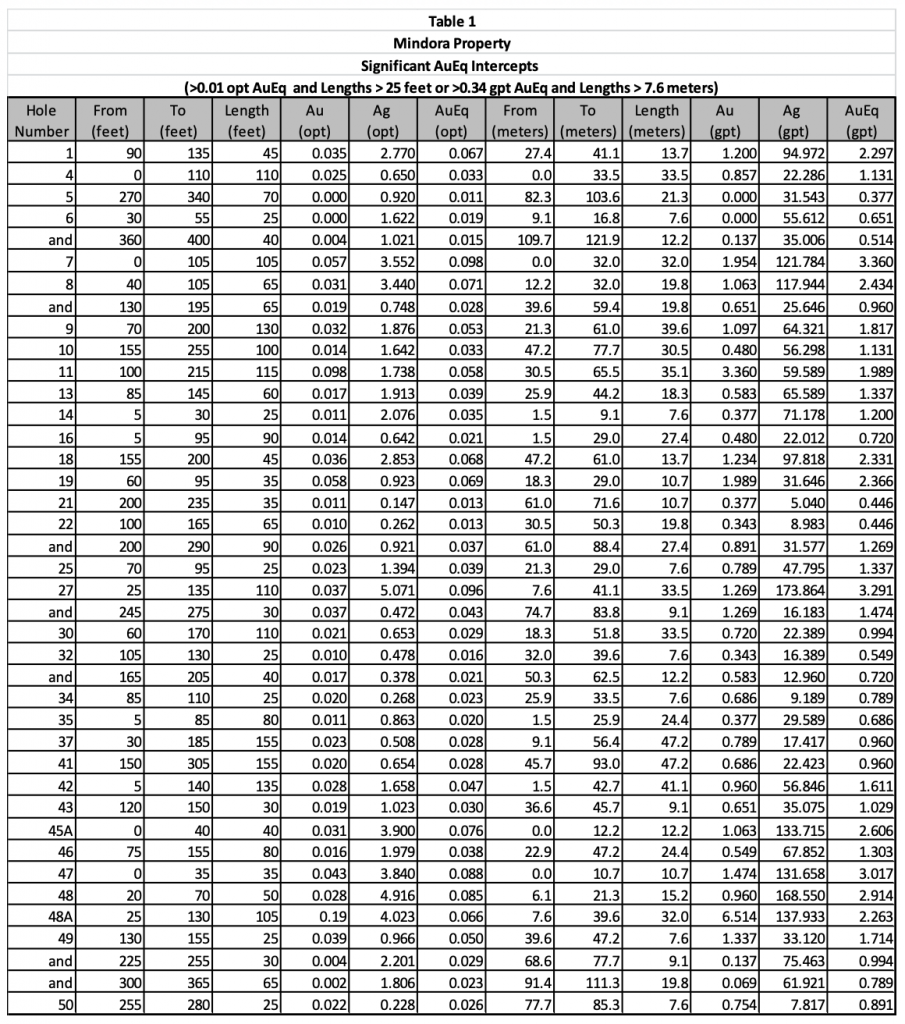

From the historic data, Emgold has summarized a list of significant gold and silver intercepts, as shown in Table 1. This table contains drill intercepts with gold grades greater than 0.01 opt (0.34 g/t) AuEq and lengths greater than 25 ft. (7.6 m). A gold price of $1,300 per ounce and a silver price of $15 per ounce were used to calculate gold equivalent grades, at a ratio of 86.7, with no allowance for metallurgical recovery. True widths of intercepts are unknown.

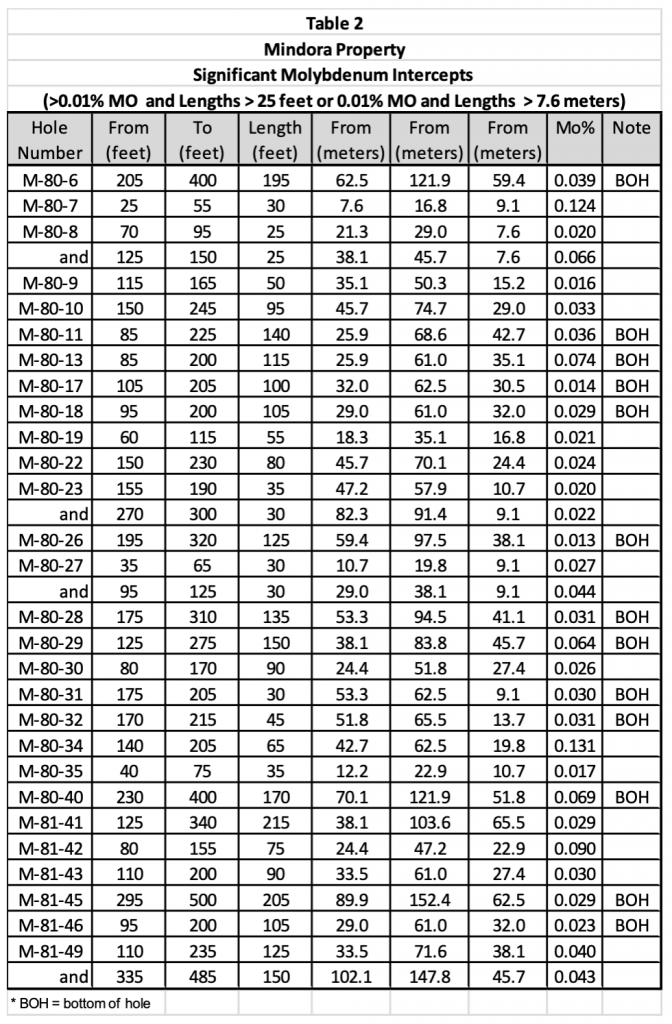

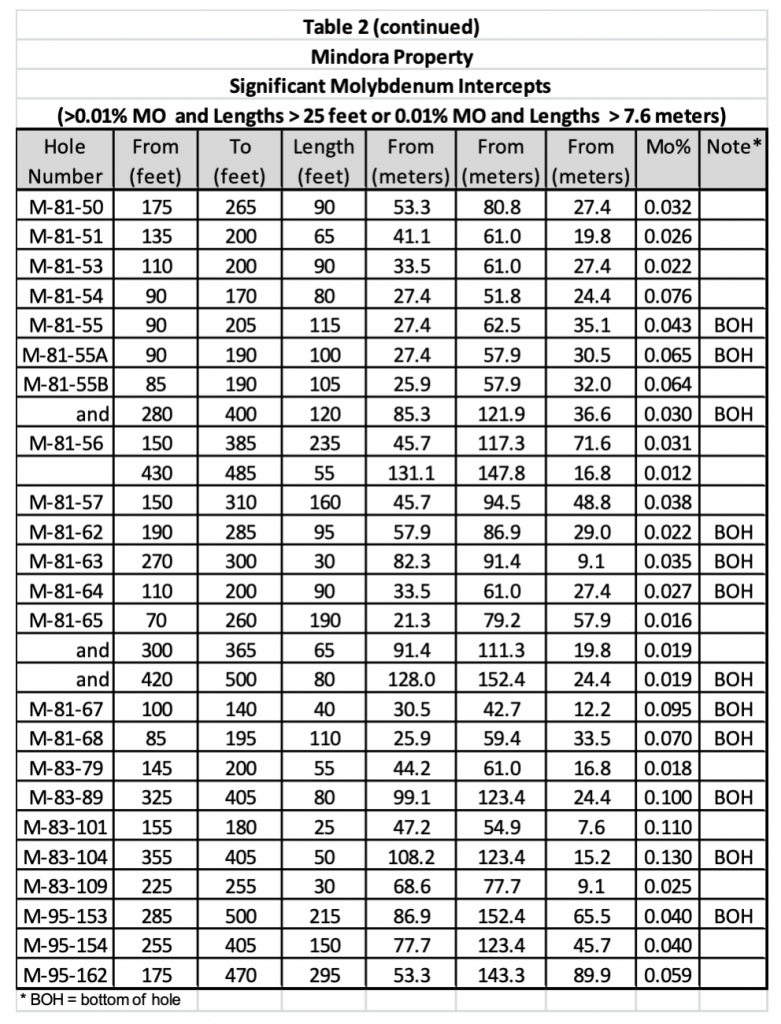

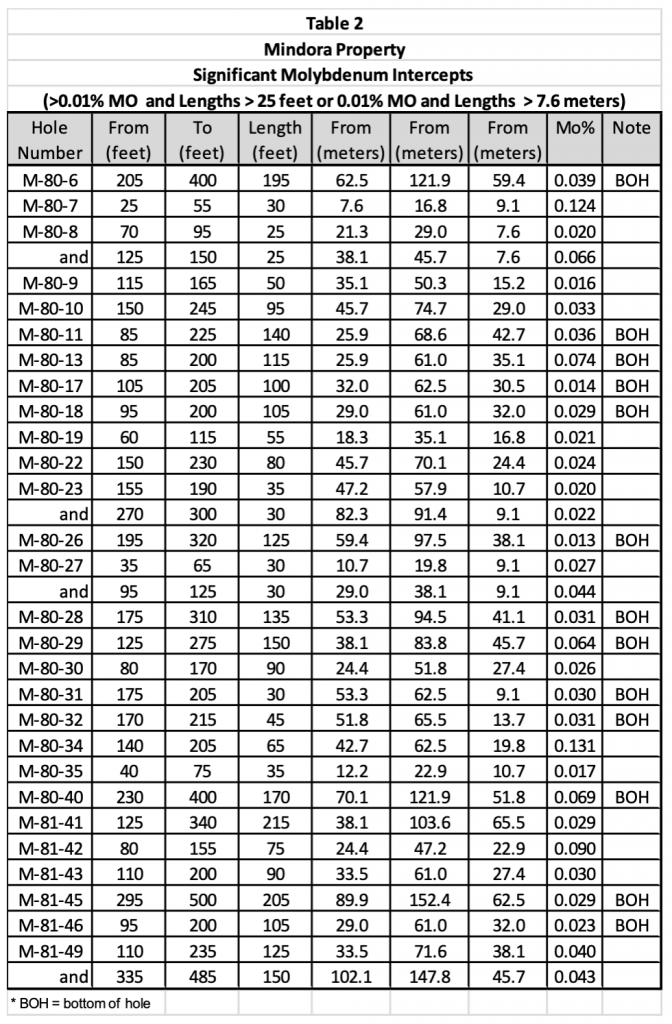

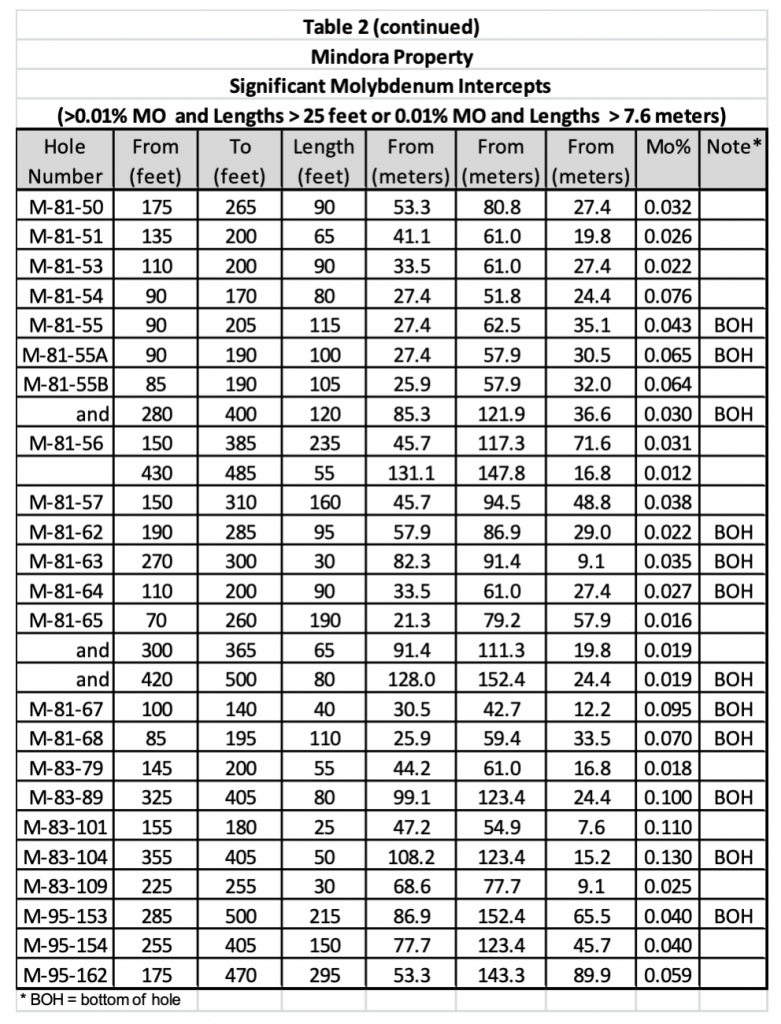

Emgold has also summarized a list of significant molybdenum intercepts, as shown in Table 2. This table contains drill intercepts with greater than 0.01% Mo and lengths greater than 25 ft. (7.6 m). Note that many holes bottomed in molybdenum mineralization. The longest intercept was 295 ft. (90 m) of 0.59% Mo from in drill-hole 162. True widths of intercepts are unknown. The porphyry moly system has been drill tested to a depth of 700 feet.

There is little assay information on copper mineralization on the Property. A report titled “Assessment Report on the Mindora Property, Mineral County, Nevada for Eureka Resource Inc.” by Myra Schatten, B.C., dated April, 1993, described copper mineralization on the Property. The report identified several copper anomalies. It concluded that copper mineralization occurs as skarns along the contact between the intrusives and the limestone and sediments, as replacement zones adjacent to intrusive and limestone sedimentary contacts, and as porphyry mineralization.

According to internal Hawthorne Gold Corporation summary reporting (1984), historic geophysical surveys completed on the Property include a 2.5 line-mile induced polarization survey (1974), a 5 line-mile VLF-EM survey (1978), 10 line-mile VLF-EM survey (1983) and a 10 line-mile ground magnetometer survey (1983). An induced polarization study was later conducted in 1995. No modern geophysics has been completed and will be a priority for exploration.

The data available on the Property was generated through exploration prior to the implementation of National Instrument NI 43-101 and CIM Standards. This data is historical in nature and Emgold has not yet completed sufficient work to independently verify these historic results, therefore they should not be relied upon. There is, however, sufficient data available to create a 3-Dimensional model of the historic data to ultimately use to guide future exploration.

Several resource estimates were done by various companies working on the Property between 1981 and 1988. Eureka evaluated a small open pit mine in 1998 based on a historic resource of 1.04M tons (0.9M tonnes) averaging 0.037 opt (1.16 gpt) gold and 1.78 opt (55.63 gpt) Ag = 0.058 opt (1.81 g/t) AuEq containing 58,800 AuEq ounces. This is a historical estimate prepared before the implementation of NI 43-101 and uses terminology not compliant with current reporting standards. A qualified person has not audited or verified this estimate nor made any attempt to re-classify the estimate according to NI 43-101 Standards of Disclosure or the CIM Standards. There are currently no mineral resources or reserves defined on the Property that meet NI 43-101 or CIM disclosure standards.

Metallurgical work completed by several laboratories in the 1980’s indicated potential recoveries of >90% for gold and 75-80% silver for milled ore and 70-75% for gold and 45-50% for silver for crushed leached ore.

Since 2020, Emgold has completed an airborne magnetic-radiometric geophysics survey of the Mindora Property. In addition, it has conducted a soil sampling program on the eastern portion of the claim block.

TECHNICAL REPORT

No Technical Report has yet been completed for the Property.

QUALIFICATIONS

Mr. Robert Pease, CPG, acting as the Qualified Person for Emgold, has reviewed and approved the information on this webpage.

REFERENCES

Campbell, E.V., Summary Report on the Luning Project, January 1989

Ernesco Resources, Mindora Project, February 4, 1985

Kerr, J.R., Summary Reprot on the Mindora Property for Hawthorne Gold Corporation, December 1984.

Lackey, Larry, Summary Report on the Mindora Project, April 6, 2016

KIlborn Engineering, Mindory Project Sudy, Hawthorne Nevada, June 1988

Schatten, Myra, Assessment Report on the Mindora Property, Mineral County, Nevada, April 1993

DISCLAIMER

Readers are cautioned to review the Disclaimer Page on this website for qualifications that may be applicable to the information contained on this Property Page, including forward looking statements, definitions of mineral resources and reserves, etc. Readers are also cautions to review Emergent's financial statements and management’s discussion and analysis available on this website or at www.sedar.com for additional information.

PROPERTY OVERVIEW

| LOCATION | 20 miles southeast of Hawthorne, NV |

| TYPE OF PROJECT | Early stage exploration |

| NUMBER OF CLAIMS | 147 unpatented claims |

| PROPERTY SIZE | 2,940 ac |

| OWNERSHIP | 135 claims owned by Emgold

12 claims under purchase agreement with Nevada Sunrise LLC |

| PROPERTY STATUS | Available for sale or option |

| UNDERLYING ROYALTIES | US $20,000 advance minimum royalty to BL Exploration on 135 unpatented claims and 2% Net Smelter Royalty, half of which can be acquired for US$200,000 prior to the 5th year of the Agreement or US$500,000 between the 5th and 9th anniversary of the Agreement |

| EXPLORATION COMPLETED |

|

| KEY EXPLORATION TARGETS |

|

| NI 43-101 TECHNICAL REPORT | None completed to date |

| MINERAL RESOURCES | None defined to date |

| EXPLORATION HIGHLIGHTS |

Historic work by others shows a conceptual higher grade target of 30,000 to 60,000 oz. @ 0.05-0.1 opt AuEq. A larger bulk disseminated target was also delineated with historic grades ranging from 0.02-0.04 opt Au. Historic drilling also encountered Mo mineralization below the Au/Ag and potential exists for a Mo/Cu porphyry system at depth. |

INTRODUCTION

On May 21, 2018, Emgold announced it had signed a Letter of Intent with Nevada Sunrise LLC, a private Nevada company, giving it the right to purchase 12 unpatented mining (the “NS Claims”). The Company has also signed a separate Letter of Intent with BL Exploration LLC, also a private Nevada company, giving it the right to purchase 18 unpatented mining claims (the “BL Claims”). On December 17, 2020, Emgold announced it has staked 117 additional unpatented claims at Mindora. Together, the 147 unpatented mining claims make up the Mindora Property (the “Property”). The Property is an early stage gold, silver, and base metal exploration property that was explored in the 1980’s and 1990’s. The Property hosts near surface gold and silver mineralization, and deeper molybdenum porphyry mineralization.

Examples of significant intercepts from historic drilling on the Property include:

- 105 ft. (32.0 m) of 0.057 opt (1.94 gpt) gold and 3.552 opt (121.78 gpt) silver in hole #7, representing a 0.098 opt (3.36 gpt) AuEq grade from a hole depth of 0 to 105 ft. (0 to 32.0 m), with true width of intercept unknown (AuEq grade based on US$1,300 per oz. gold price and US$15 per oz. silver price, with no adjustment for recovery); and

- Hole No. 162 with 295 ft. (90 m) of 0.59% Mo from a hole depth of 175 to 470 feet, with true width of intercept unknown.

The exploration targets at Mindora include:

- A near surface higher grade gold and silver target (possible size of 30,000-50,000 AuEq ounces. at >0.75 AuEq opt) that may have potential to be mined by open pit methods with offsite processing;

- A lower grade gold-silver target (possible size of 300,000-500,000 AuEq ounces. >0.03 opt AuEQ) that represents a larger bulk disseminated deposit, similar to the nearby historic Santa Fe Mine, that has potential to be mined using open pit methods with on-site processing; and

- Deeper molybdenum and copper targets that would have potential for open pit or underground mining with onsite processing.

Note that there are currently no mineral resources or mining reserves yet defined at Mindora that meet NI 43-101 Standards for Disclosure or CIM Standards and these are targets only. Additional exploration is needed to develop resources and ultimately mineral reserves.

Mindora Property – Looking East

LOCATION & OWNERSHIP

The Property is a gold, silver, and base metal property located 20 miles southeast of Hawthorne, in the Garfield Hills, Mineral County, Nevada.Emgold signed two Letters of Intent to consolidate 30 contiguous unpatented mining claims and subsequently staked 117 additional unpatented claims, for a total of 147 unpatented claims that now make up the Property. The Property has regional synergy with Emergent's other properties in the Walker Lane structural trend in western Nevada and is near Emergent's New York Canyon Property, located about 12 miles away.

Mindora Property

Location Map

Terms of the Nevada Sunrise LLC Transaction

Subject to a Definitive Agreement dated June 15, 2019 and Amendment No. 1 to this Agreement dated December 23, 2020, Emgold has agreed to purchase a 100 percent interest in the 12 unpatented mining claims, the NS Claims, from Nevada Sunrise LLC, under the following terms:

- US$25,000 on or before December 31, 2019 (paid);

- US$25,000 on or before February 29, 2020 (paid); and

- US$25,000 per year on the anniversary date of the closing for a period of four years, for a total purchase price of US$150,000.

Terms of the BL Exploration LLC Transaction

Subject to a Definitive Agreement dated June 15, 2019 and Amendment No. 1 to this Agreement dated December 23, 2020, Emgold has purchased a 100 percent interest in 18 unpatented mining from BL Exploration LLC for US$50,000. The BL Claims will be subject to a US$20,000 per year advance royalty.

Emgold will assign a 2% NSR royalty to BL Exploration on the claims. Emgold will have the option of acquiring one-half of the 2% NSR for US$200,000 on or before the fifth anniversary of the closing of the transaction. Should Emgold not exercise this option, it will have a second option of acquiring ½ of the 2% NSR for US$500,000 after the fifth anniversary and before the ninth anniversary of the closing of the transaction.

GEOLOGY & MINERALIZATION

Limestone and intermediate volcanic rocks of the Triassic Luning Formation underlie the east and central portions of the Property. Quartz rhyolite and quartz latite dikes and sills, and altered granodiorite, intrude the meta-sedimentary and metavolcanic rocks. Late Tertiary volcanic rocks and overburden cover the western portion of the Property.

The gold-silver zone is an epithermal, carbonate-hosted, structurally controlled deposit in the Luning Limestone Formation. Mineralization is primarily situated along two northeast-trending fault zones, known as the Mindora lineament and the Santa Fe lineament. The gold-silver mineralization appears to be in pods of highly sheared, shattered and altered limestone. Many of the shallow holes testing near-surface gold-silver mineralization intercepted and ended in an extensive molybdenum stockwork system. The molybdenum is related to quartz latite and quartz porphyry dikes. The extent of the molybdenum system is not known. There is also evidence of copper skarn and copper porphyry mineralization on the Property from surface sampling, but no drilling has been done to test these targets. The dominant structures are northeast trending faults and secondary structures are northwest trending Walker Lane related faults.

Mindora Property

Claim Map, Drill Hole Locations, Structures, and Mineralized Zone (no scale)

EXPLORATION

The Property was discovered and worked in the late 1800’s. In the 1920’s with a limited amount of production came from a series of rich, silver-bearing veins. During the period 1946-1948, an estimated 10,000 tons of direct-shipping ore was mined from the Property at unknown grade.

In the 1970’s, geologists recognized the epithermal nature of mineralization, and similarities to the nearby Santa Fe deposit and other carbonate-rich sediment-hosted gold deposits in Nevada. The Santa Fe deposit was discovered in the late 1970’s and mined by Corona Gold in the late 1980’s and early 1990’s. Historic production estimated from Santa Fe Mine is 345,499 ounces of gold and 710,629 ounces of silver between 1989 and 1995 (source: The Nevada Mineral Industry, Special Publication MI-2017, Nevada Bureau of Mines and Geology). Note that the vicinity of the Property to a past producing mine is not necessarily indicative of the mineralization that may be hosted at Property. The historic Santa Fe Gold Mine is now owned by Victoria Gold Corporation (TSX:V: VIT) (“Victoria Gold”) and is in a reclamation phase.

Several companies staked the Property during this period, did limited sampling and geophysics, and then dropped their claims. Hawthorne Gold Corporation acquired the Property in 1979, and in the following year, brought in E & B Exploration Inc. as a joint-venture partner and operator. E & B completed programs of rock-chip sampling and trench sampling, surface and underground mapping, geophysical surveys, and drilled approximately 31,425 ft. (9,578 m) in 134 holes (including a water-well and two diamond core holes). E & B’s work developed four known mineralized zones.

Eureka Resources, Inc. acquired E & B’s interest in 1983. Eureka conducted IP, magnetic and VLF electromagnetic surveys, soil and rock-chip sampling and drilled an additional approximately 11,441 ft. (3,487 m) in 40 holes. In 1988, Eureka commissioned metallurgical studies and a detailed review by Kilborn Engineering with the goal of developing a small open pit gold mine.

Historic exploration resulted in the discovery of four separate mineralized zones. The grades of these zones ranged from 0.022 to 0.041 opt gold, and 0.88 to 2.08 opt silver. One goal of Emergent's exploration will be to combine these zones into one or two larger zones with infill drilling.

Eureka failed to file assessment work on the claims in 2001 and Nevada Sunrise LLC and BL Exploration staked the Property in 2001 and 2003, resulting in the current land package of the NS and BL Claims, respectively. Little exploration work has been done on the property since the last drilling program, completed in 1995.

Total drilling on the Property is about 42,836 ft., mostly in vertical holes in the range of 200-300 ft. Average depth is 250 ft. and maximum drilling depth of 700 ft. (214 m).

From the historic data, Emgold has summarized a list of significant gold and silver intercepts, as shown in Table 1. This table contains drill intercepts with gold grades greater than 0.01 opt (0.34 g/t) AuEq and lengths greater than 25 ft. (7.6 m). A gold price of $1,300 per ounce and a silver price of $15 per ounce were used to calculate gold equivalent grades, at a ratio of 86.7, with no allowance for metallurgical recovery. True widths of intercepts are unknown.

Emgold has also summarized a list of significant molybdenum intercepts, as shown in Table 2. This table contains drill intercepts with greater than 0.01% Mo and lengths greater than 25 ft. (7.6 m). Note that many holes bottomed in molybdenum mineralization. The longest intercept was 295 ft. (90 m) of 0.59% Mo from in drill-hole 162. True widths of intercepts are unknown. The porphyry moly system has been drill tested to a depth of 700 feet.

There is little assay information on copper mineralization on the Property. A report titled “Assessment Report on the Mindora Property, Mineral County, Nevada for Eureka Resource Inc.” by Myra Schatten, B.C., dated April, 1993, described copper mineralization on the Property. The report identified several copper anomalies. It concluded that copper mineralization occurs as skarns along the contact between the intrusives and the limestone and sediments, as replacement zones adjacent to intrusive and limestone sedimentary contacts, and as porphyry mineralization.

According to internal Hawthorne Gold Corporation summary reporting (1984), historic geophysical surveys completed on the Property include a 2.5 line-mile induced polarization survey (1974), a 5 line-mile VLF-EM survey (1978), 10 line-mile VLF-EM survey (1983) and a 10 line-mile ground magnetometer survey (1983). An induced polarization study was later conducted in 1995. No modern geophysics has been completed and will be a priority for exploration.

The data available on the Property was generated through exploration prior to the implementation of National Instrument NI 43-101 and CIM Standards. This data is historical in nature and Emgold has not yet completed sufficient work to independently verify these historic results, therefore they should not be relied upon. There is, however, sufficient data available to create a 3-Dimensional model of the historic data to ultimately use to guide future exploration.

Several resource estimates were done by various companies working on the Property between 1981 and 1988. Eureka evaluated a small open pit mine in 1998 based on a historic resource of 1.04M tons (0.9M tonnes) averaging 0.037 opt (1.16 gpt) gold and 1.78 opt (55.63 gpt) Ag = 0.058 opt (1.81 g/t) AuEq containing 58,800 AuEq ounces. This is a historical estimate prepared before the implementation of NI 43-101 and uses terminology not compliant with current reporting standards. A qualified person has not audited or verified this estimate nor made any attempt to re-classify the estimate according to NI 43-101 Standards of Disclosure or the CIM Standards. There are currently no mineral resources or reserves defined on the Property that meet NI 43-101 or CIM disclosure standards.

Metallurgical work completed by several laboratories in the 1980’s indicated potential recoveries of >90% for gold and 75-80% silver for milled ore and 70-75% for gold and 45-50% for silver for crushed leached ore.

Since 2020, Emgold has completed an airborne magnetic-radiometric geophysics survey of the Mindora Property. In addition, it has conducted a soil sampling program on the eastern portion of the claim block.

TECHNICAL REPORT

No Technical Report has yet been completed for the Property.

QUALIFICATIONS

Mr. Robert Pease, CPG, acting as the Qualified Person for Emgold, has reviewed and approved the information on this webpage.

REFERENCES

Campbell, E.V., Summary Report on the Luning Project, January 1989

Ernesco Resources, Mindora Project, February 4, 1985

Kerr, J.R., Summary Reprot on the Mindora Property for Hawthorne Gold Corporation, December 1984.

Lackey, Larry, Summary Report on the Mindora Project, April 6, 2016

KIlborn Engineering, Mindory Project Sudy, Hawthorne Nevada, June 1988

Schatten, Myra, Assessment Report on the Mindora Property, Mineral County, Nevada, April 1993

DISCLAIMER

Readers are cautioned to review the Disclaimer Page on this website for qualifications that may be applicable to the information contained on this Property Page, including forward looking statements, definitions of mineral resources and reserves, etc. Readers are also cautions to review Emergent's financial statements and management’s discussion and analysis available on this website or at www.sedar.com for additional information.