PROPERTY OVERVIEW

| LOCATION | 30 miles east of Hawthorne, NV |

| TYPE OF PROJECTS | Advanced stage exploration |

| NUMBER OF CLAIMS | 21 patented and 417 unpatented claims |

| PROPERTY SIZE | 8,700 acres |

| OWNERSHIP |

|

| PROPERTY STATUS | Earn-in with Option to Joint Venture Agreement with Kennecott Exploration where Kennecott can earn up to a 75% interest in the Property by making expenditures of up to US$22.5 million |

| UNDERLYING ROYALTIES |

|

| EXPLORATION COMPLETED |

|

| KEY EXPLORATION TARGETS |

|

| NI 43-101 TECHINCAL REPORT |

2010 Technical Report completed by Searchlight Resources on Longshot Ridge deposit |

| MINERAL RESOURCES |

|

| EXPLORATION HIGHLIGHTS |

|

INTRODUCTION

The New York Canyon Property (“NYC” or the “Property”) is an early stage exploration property located about 30 miles east of Hawthorne Nevada. It consists of 21 patented claims and 417 patented claims and is under an Earn-in with Option to Joint Venture Agreement with Kennecott Exploration Company (“KEX”). KEX is a subsidiary of Rio Tinto Plc (NYSE: RIO). Kennecott can earn up to a 75% interest in the Property by completing up to US$22.5 million in expenditures (see details below).

The Property is an early stage base metal exploration property that was explored from the mid-1960’s until the mid- 2000’s for near surface copper oxide skarn mineralization and deeper copper-molybdenum sulfide porphyry mineralization. Three known exploration targets on the southern portion of the Property include Longshot Ridge, Copper Queen, and Champion.

Drilling by Conoco, reported in a May 10, 1979 internal report, included a significant interval of chalcopyrite and molybdenite mineralization in drill-hole MN-42, drilled in 1977, intersecting 1,020 ft. (311m) of 0.41% copper, 0.012% molybdenum, 4.5 ppm silver, and 0.1 ppm gold from 560 ft. (171 m) to 1,580 feet (482 m) (true width unknown) at the Copper Queen prospect, located approximately 2 mi. (3 km) west of the Longshot Ridge prospect (see details below).

Conoco reported a 142 million tons (129 million tonnes) inferred resource grading 0.35% copper, 0.015% molybdenum, 0.1% Zn, 4 ppm silver, and 0.1 ppm gold for the Copper Queen deposit in the internal report dated May 10, 1979. In another internal report completed on September 20, 1979, Conoco reported “possible reserves from drill-hole data and geologic interpretation on cross sections” of 13.2 million tons (11.0 million tonnes) grading 0.55% copper for the Longshot Ridge prospect. These are a historic resource before the implementation of NI 43-101 and CIM Standards. Emergent's geologists have not verified the calculations or attempted to reclassify them according to current standards.

In a 2010 Technical Report, Searchlight defined a historic indicated resource of 16.3 million tons (14.8 million tonnes) of 0.43% copper and an historic inferred resource of 2.9 million tons (2.6 million tonnes) of 0.31% copper in the Longshot Ridge copper oxide skarn area was defined. A cut-off grade of 0.20% copper was used. This resource is being treated as a historic resource by Emergent's geologists and no work has been done to verify the calculations or update them to treat the resource as current.

The exploration targets on the north part of the Property abut the historic The Santa Fe deposit was discovered in the late 1970’s and mined by Corona Gold in the late 1980’s and early 1990’s. Historic production estimated from Santa Fe Mine is 345,499 ounces of gold and 710,629 ounces of silver between 1989 and 1995 (see details below).

New York Canyon therefore hosts near surface copper oxide skarn exploration targets, deeper copper/molybdenum porphyry exploration targets, and may also host gold-silver exploration targets. Under the terms of the Earn-in with Option to Joint Venture Agreement, KEX plans to conduct exploration on the Property and is in charge of defining and implementing exploration programs and budgets to meet their expenditure requirements.

New York Canyon Property

Looking East

LOCATION & OWNERSHIP

The Property is located in the Santa Fe Mining District, Mineral County, in west-central Nevada, about 30 mi. (48 km) from Hawthorne, Nevada. The Property has synergy with Emergent's other properties in the Walker Lane structural trend on the western side of Nevada and locational synergy with Emergent's Mindora Property that is located 12 miles west..

The Property was originally optioned by Emgold from Searchlight Resources Corporation (TSXV: SCLT) (“Searchlight”) (see May 28, 2019 and July 16, 2019 press releases). At the time, the Property consisted of 21 patented claims and 60 unpatented claims totaling about 1,500 ac. (607 ha). The claims are divided into two groups – the North and South Groups.

The North Group of claims on the Property cover historic past producing copper workings and gold occurrences and is adjacent to the past producing Santa Fe Gold Mine owned by Victoria Gold Corporation (TSX:V: VIT) (“Victoria Gold”) The Santa Fe deposit was discovered in the late 1970’s and mined by Corona Gold in the late 1980’s and early 1990’s. Historic production estimated from Santa Fe Mine is 345,499 ounces of gold and 710,629 ounces of silver between 1989 and 1995 (source: The Nevada Mineral Industry, Special Publication MI-2017, Nevada Bureau of Mines and Geology). Note that the vicinity of the Property to a past producing mine is not necessarily indicative of the mineralization that may be hosted at New York Canyon Property.

The South Group of claims comprising the Property hosts the Longshot Ridge, Champion, and Copper Queen deposits, which includes copper skarn oxide, copper skarn sulfide, and copper sulfide porphyry mineralization.

Emgold agreed to purchase a 100 percent interest in the claims comprising the Property from Searchlight under the following terms:

- C$10,000 on signing the LOI (paid);

- C$40,000 on closing of the Transaction (paid);

- C$500,000 in common shares of the capital of Emgold at the date of closing, with the share price based on the 30-day volume weighted average price of the Company’s share immediately prior to the announcement of the Transaction (issued);

- C$100,000 within 6 months of the date of closing of the Transaction (paid*);

- C$100,000 within 12 months of the date of closing of the Transaction (paid*); and

- C$100,000 within 18 months of the date of closing of the Transaction (paid*).

*Note that Emgold had an option to make a reduced payment of C$225,000 in lieu of the three x C$100,000 payments. The C$225,000 payment had to be made before the 6 month anniversary of the Emgold-Searchlight Agreement. Emgold subsequently completed an Earn-in with Option to Joint Venture Agreement with Kennecott. Kennecott paid the C$225,000, on behalf of Emgold, as part of their expenditures under the Emgold-Kennecott Agreement.

On November 15, 2019, Emgold announced it had increased the size of the Property by staking and additional 92 unpatented claims.

On February 11, 2020, Emgold announced it had signed an Earn-in with Option to Joint Venture Agreement with Kennecott. Key points of the agreement include:

- Kennecott will have an option (the “First Option”) to acquire a 55% undivided interest in the Property by incurring US$5.0 million in expenditures over a 5 year period, of which US$1.0 million is a required expenditure that must be completed prior to the 18 month anniversary of the Agreement.

- Kennecott will have a second option (the “Second Option”) to earn an additional 10% undivided interest in the Property (for a total of 65%) by incurring an additional US$7.5 million in expenditures over a 3 years period.

- Kennecott will have a third option (the “Third Option”) to earn an additional 10% undivided interest in the Property (for a total of 75%) by incurring an additional US$10 million in expenditures over a three year period.

- Any expenditure in excess of an option expenditure requirement in a given time period will be credited against subsequent option expenditure requirements. Kennecott may, at any time or from time to time, accelerate its satisfaction of the First, Second, or Third Option by paying Emgold money in lieu of incurring expenditures.

- While earning in, Kennecott will have the right to make exploration and development decisions.

- Kennecott must maintain the Property in good standing during the option period(s), including payment of BLM and County maintenance fees and any underlying property payments due to Searchlight Resource Corporation. As described above Emgold had an underlying agreement to acquire a 100 percent interest in the Property from Searchlight, which required three remaining payments over an 18 month period totaling CDN$300,000. Emgold had an option to reduce this payment to C$225,000 as described above.

- Kennecott will have the right to elect to form a joint venture (the “Joint Venture”) with Emgold upon completion of either the First, Second, or Third Option. Upon establishing a Joint Venture each participant will fund the joint venture according to its participating interest, with Kennecott acting as the Manager of the joint venture. If a party’s participating interest falls below 10%, then such parties participating interest will be converted to a 1% Net Smelter Royalty, capped at US$25 million.

On March 30, 2020, Emgold announced it completed its option and had acquired a 100% interest in the 21 patented claims and 60 unpatented claims from Searchlight. Including the 92 claims staked by Emgold and the 265 claims staked by Kennecott, the current size of the property is 21 patented claims and 417 unpatented claims.

New York Canyon Property

Location Map

GEOLOGY & MINERALIZATION

The Property lies within the central portion of the Walker Lane structural belt, a broad zone of NW-SE striking parallel to sub-parallel right lateral strike-slip faults extending for more than 400 miles through western Nevada and into northern and southern California. The structural belt was initiated during the Jurassic period at which time a number of porphyry copper deposits and related skarn deposits were formed. Volcanism and related hydrothermal mineralization, often of Tertiary age, are recognized along the length of this structural trend.

Copper mineralization is hosted primarily within the Triassic-age Gabbs Formation limestone sequence and within the underlying Triassic-age Luning Formation limestone units and overlying Jurassic-age Sunrise Formations limestone sequence. Mineralization in skarns is adjacent to Cretaceous age felsic intrusive rocks. Non-mineralized volcanic flows of Tertiary-age cover these older rocks on the hills and Quaternary–age alluvium and colluvium cover them in the valleys.

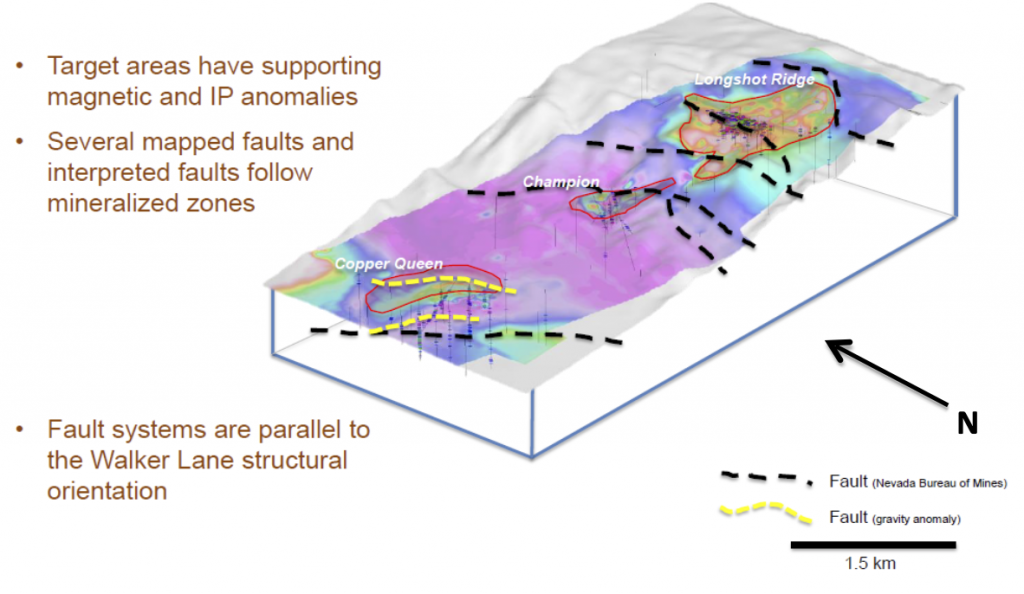

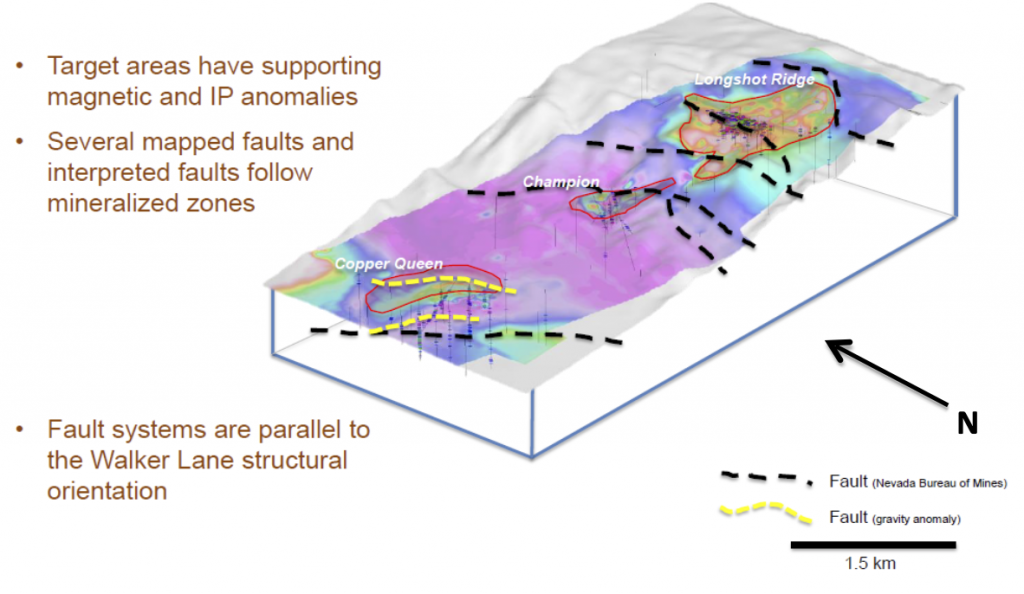

Mineralization is associated with three principal occurrences – Copper Queen on the west, Champion on the center, and Longshot Ridge on the east side of the claims. The copper occurrences lie along a west-northwest trend that likely reflects the deeper basement structures.

New York Canyon

Main Deposits and Structures

The Copper Queen prospect has no exposed mineralization at the surface but contains copper sulfide skarn at depth and an incompletely confirmed copper-molybdenum sulfide porphyry system at greater depth. The Champion and Longshot Ridge prospects, however, have numerous widespread exposures of copper skarn mineralization, both in surface outcrop and in old mine workings. The majority of recent exploration efforts on the Property have focused on the extensive oxide copper skarn mineralization at Longshot Ridge. The principal alteration and mineralization at Longshot Ridge occurs as copper-rich skarn in porous and permeable zones within sedimentary rock units of the Luning, Gabbs and Sunrise Formations. Additionally, small amounts of copper mineralization occur in stockwork veinlets in permeable fractures in some of the porphyritic intrusive sills and dikes that intrude the sedimentary rock units. The alteration associated with mineralization in these intrusive bodies consists of argillization, phyllic, and silicification – typical for this type of rock.

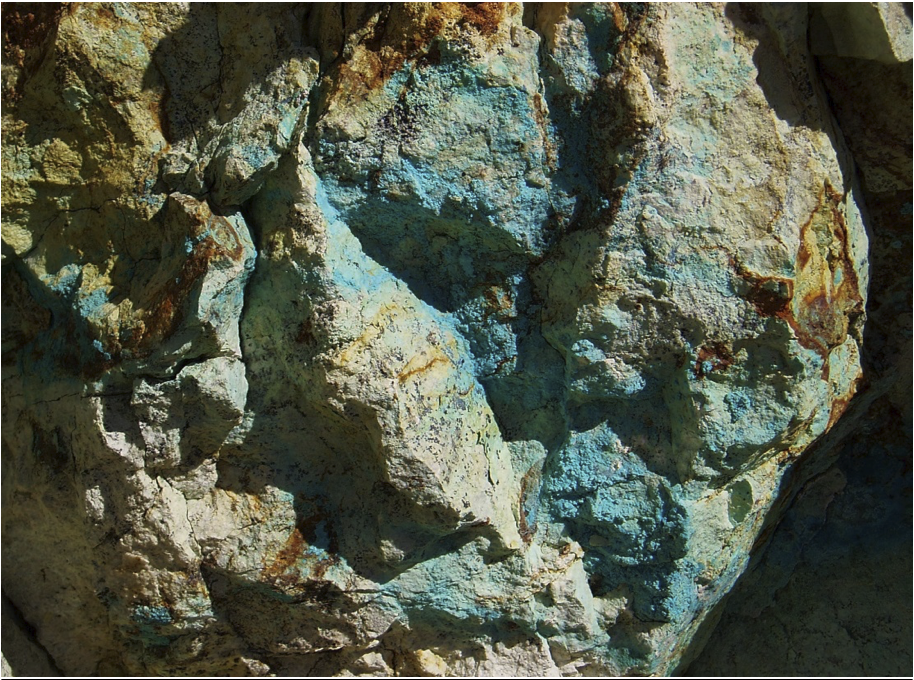

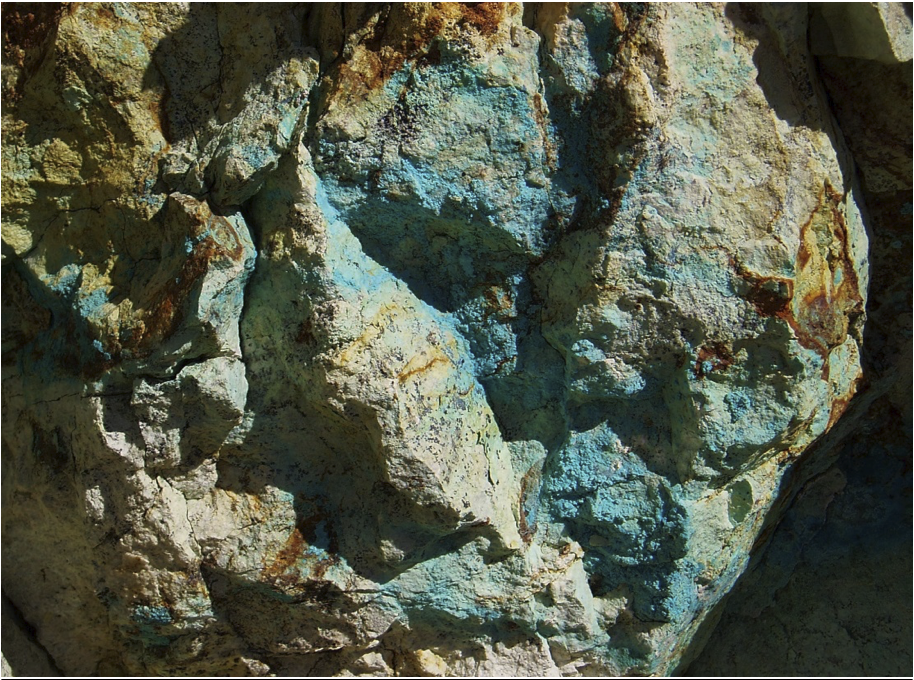

At Longshot Ridge, the oxide copper minerals are apparently the products of supergene weathering and oxidation of primary copper sulfide minerals present in the original skarn. The copper mineralization consists almost entirely of secondary copper minerals, principally malachite, azurite, chrysocolla and copper wad. Additionally, some copper-rich limonite (goethite) is reported, and a fairly common greenish alteration mineral is thought to be a zinc bearing clay. Because limestones tend to buffer solutions carrying copper in a supergene environment, copper weathered from the skarn sulfide minerals migrates to the non-skarn limestone units where it may be enriched as much as 300 to 400 percent.

New York Canyon Property

Oxidized Mineralization at Longshot Ridge

EXPLORATION

The discovery of these deposits dates back to 1875 and historic production, by the Wall Street Copper Company during 1906-1929, came from a number of small surface showings in the Longshot Ridge area. Historic production is reported to be 8.9 million pounds (4.04 million kg) of copper at an average grade of 5.5% (source: USGS Mineral Resource Data System, Deposit ID 10301559, New York Canyon / Longshot Ridge Project).

In the mid-1960s to the late-1970s, several companies explored the Property for major copper porphyry deposits. This work defined additional copper oxide skarn mineralization at Longshot Ridge and copper sulfide skarn and porphyry mineralization at the Copper Queen prospects. Historic drilling by Conoco, the operator of the Property from 1977 to 1991, totaled 107 holes totaling approximately 98,433 ft. (30,000 m).

Drilling by Conoco, reported in a May 10, 1979 internal report, included a significant interval of chalcopyrite and molybdenite mineralization in drill-hole MN-42, drilled in 1977, intersecting 1,020 ft. (311m) of 0.41% copper, 0.012% molybdenum, 4.5 ppm silver, and 0.1 ppm gold from 560 ft. (171 m) to 1,580 ft. (482 m) (true width unknown) at the Copper Queen prospect, located approximately 2 mi. (3 km) west of the Longshot Ridge prospect.

Between 1992 and 1997 Kookaburra Resources Ltd. (“Kookaburra”) conducted further exploration, including exploration with various joint venture partners, including Coca Mines and Phelps Dodge. They tested the Longshot Ridge and Copper Queen skarns with an additional 54 drill-holes totaling 13,018 ft. (3,968 m). The primary goal of this exploration was to increase the size of the oxide skarn resource.

Subsequent to Kookaburra’s work on the Property, the unpatented claims lapsed in 1999. New unpatented claims were staked by two individuals and subsequently acquired by Nevada Sunrise LLC (“Nevada Sunrise”), a privately held Nevada corporation, along with rights to acquire the patented claims.

Aberdene Mines Ltd. (subsequently Canyon Copper Corporation and then Searchlight Resources Incorporated) acquired an option on the Property from Nevada Sunrise in March, 2004 and subsequently acquired rights to both the patented and unpatented claims that make up the current Property. Searchlight completed 27,605 ft. (8,414 m) of drilling in 73 holes, focused on the Longshot Ridge deposit.

Total historic drilling on the Property to date is therefore 234 holes totaling 139,056 ft. (43,384 m). No drilling on the Property has been done since 2006. Searchlight completed a NI 43-101 Technical Report on the Longshot Ridge Project in 2010, including a resource estimate. This Technical Report includes drilling to 2005 and excluded drilling done in 2006.

New York Canyon Property

2006 Drilling Program

QA/QC procedures on historic work are unknown and work was completed prior to the implementation of NI 43-101 Standards of Disclosure and CIM Standards. Work was completed by reputable companies and it is expected industry standards were followed.

Work done by Searchlight was done after the implementation of NI 43-101 Standards of Disclosure and CIM Standards. Sampling methods, analysis, and security of samples for their work is detailed in the 2010 Technical Report completed by Searchlight.

In completing the 2010 Technical Report, it was noted that during the 2006 drill program there was a change in laboratories part way through the drilling program. The labs used a different set of procedures for sample preparation and copper analysis. The check-assay system identified a variation in sample results between the labs, including analysis of sample blanks. It was recommended that re-assays be done at a third party lab and the 2006 drill data was not used in the 2010 resource estimate. The 2006 drill program included 7 HQ sized diamond drill holes totaling 2,805 ft. (855 m) and 26 RC holes totaling 8,828 ft. (2,688 m).

Historic work on the Property includes induced polarization (IP), ground magnetic (GMAG), and gravity (GRAV) surveys spanning from the mid-1960’s to 2004. In 2006, Wright Geophysics reviewed the historic data and completed new GMAG and IP studies.

Several historic resource estimates were done. Conoco reported a 142 million tons (129 million tonnes) inferred resource grading 0.35% copper, 0.015% molybdenum, 0.1% Zn, 4 ppm silver, and 0.1 ppm gold for the Copper Queen deposit in the internal report dated May 10, 1979. In another internal report completed on September 20, 1979, Conoco reported “possible reserves from drill-hole data and geologic interpretation on cross sections” of 13.2 million tons (11.0 million tonnes) grading 0.55% copper for the Longshot Ridge prospect. These are historical reserve and resource estimates prepared prior to the implementation of NI 43-101 and use terminology not compliant with current reporting standards. A qualified person has not audited or verified these historical estimates nor made any attempt to re-classify the estimates according to current NI 43-101 Standards of Disclosure or the CIM standards.

In a 2010 Technical Report, Searchlight defined a historic indicated resource of 16.3 million tons (14.8 million tonnes) of 0.43% copper and an historic inferred resource of 2.9 million tons (2.6 million tonnes) of 0.31% copper in the Longshot Ridge copper oxide skarn area. A cut-off grade of 0.20% copper was used. This mineral resource estimate is considered historical as defined by NI 43-101 and a qualified person has not audited or verified this resource as a current mineral resource. A qualified person has not done sufficient work to classify the historical estimate as current mineral resources or mineral reserves. The Company is not treating the historical estimate as current mineral resources or mineral reserves.

The historic Searchlight mineral resource for Longshot Ridge was estimated using industry standards that conformed with CIM Definition Standards on Mineral Resources and Mineral Reserves. The mineral resource estimate database contains 58 historic drill holes from prior operators to Searchlight totaling 18,469 feet, 38 drill holes (10 HQ diamond drill holes and 28 reverse circular drill holes) totaling 14,585 feet completed by Searchlight during the period from 2004 to 2005, and various surface and trench samples from 34 trenches and road cuts obtained from Longshot Ridge. The estimate does not include 33 drill holes (7 HQ diamond drill holes and 26 reverse circulation holes) completed by the Company in 2006.

Outlier high copper assays were capped at 4% Cu within the mineralized solid and at 1.3% Cu if outside the solid. Uniform 20 ft. composites were produced both inside and outside the mineralized solid from capped Cu values. Semivariograms were produced for Cu inside and outside the mineralized solid and used both to estimate and classify the resource. A three-dimensional geological and block model was generated using Gemcom and Techbase software. A block model with blocks of 50 x 50 x 40 feet in dimensions was placed over the mineralized solid with the percentage below topography and inside the mineralized solid recorded in each block. Densities of 2.94 for the mineralized zone and 2.70 outside the mineralized zone were used. Copper grades were interpolated into all blocks by using an ordinary kriging estimation method. Blocks were classified as either indicated or inferred based on grade continuity quantified by the semivariogram.

To upgrade the historic resource to current, it was recommended that drilling by Searchlight from 2006 be re-assayed due to QA/QC issues identified in the 2010 Technical Report and the new data be incorporated into the resource model.

Both Conoco and Kookaburra conducted metallurgical tests including included alkaline and acid bottle roll leaching and flotation. Conoco’s work focused on the Copper Queen sulfide mineralization while Kookaburra focused on the copper oxide mineralization at Longshot Ridge.

In 2005, McClelland Labs conducted specific gravity tests on 10 Longshot Ridge core samples from one drill hole. These tests are not considered to be representative of the deposit because they came from a single hole. In 2007, SGS Lakefield Research conducted various metallurgical tests to determine the best methods to recover copper at Longshot Ridge. They concluded acid leaching showed the greatest recoveries, but acid consumption was high. Additional test work is needed to optimize metallurgical recovery and that more samples are needed to be more representative of the deposit.

TECHNICAL REPORT

No Technical Report has yet been completed for the Property.

QUALIFICATIONS

Mr. Robert Pease, CPG, acting as the Qualified Person for Emgold, has reviewed and approved the information on this webpage.

REFERENCES

Bollig, D.W. and Robinson, R.H. Initial Mining Costs Estimated tor Long Shot Ridge, Santa Fe Mining District, Mineral County, Nevada, Conoco Inc., Minerals Department, September 20, 1979

Broili, Chris; Klohn, Mel; and Giroux, Garry, Technical Report on the New York Canyon Copper Project, Nevada USA, Prepared for Canyon Copper Corp., April 6, 2010

Cowdery, P.H., Technical Report on the Longshot Ridge Copper Oxide Project, Core Engineering Associates for Kookaburra Resources Ltd., April 1993, April 23, 1993, revised June 23, 1993

Long, Roney C., Progress Report for the Copper Queen Area, New Your Canyon Project, Continental Oil Company Minerals Department, May 10, 1979

DISCLAIMER

Readers are cautioned to review the Disclaimer Page on this website for qualifications that may be applicable to the information contained on this Property Page, including forward looking statements, definitions of mineral resources and reserves, etc. Readers are also cautions to review Emergent's financial statements and management’s discussion and analysis available on this website or at www.sedar.com for additional information.

PROPERTY OVERVIEW

| LOCATION | 30 miles east of Hawthorne, NV |

| TYPE OF PROJECTS | Advanced stage exploration |

| NUMBER OF CLAIMS | 21 patented and 417 unpatented claims |

| PROPERTY SIZE | 8,700 acres |

| OWNERSHIP |

|

| PROPERTY STATUS | Earn-in with Option to Joint Venture Agreement with Kennecott Exploration where Kennecott can earn up to a 75% interest in the Property by making expenditures of up to US$22.5 million |

| UNDERLYING ROYALTIES |

|

| EXPLORATION COMPLETED |

|

| KEY EXPLORATION TARGETS |

|

| NI 43-101 TECHINCAL REPORT |

2010 Technical Report completed by Searchlight Resources on Longshot Ridge deposit |

| MINERAL RESOURCES |

|

| EXPLORATION HIGHLIGHTS |

|

INTRODUCTION

The New York Canyon Property (“NYC” or the “Property”) is an early stage exploration property located about 30 miles east of Hawthorne Nevada. It consists of 21 patented claims and 417 patented claims and is under an Earn-in with Option to Joint Venture Agreement with Kennecott Exploration Company (“KEX”). KEX is a subsidiary of Rio Tinto Plc (NYSE: RIO). Kennecott can earn up to a 75% interest in the Property by completing up to US$22.5 million in expenditures (see details below).

The Property is an early stage base metal exploration property that was explored from the mid-1960’s until the mid- 2000’s for near surface copper oxide skarn mineralization and deeper copper-molybdenum sulfide porphyry mineralization. Three known exploration targets on the southern portion of the Property include Longshot Ridge, Copper Queen, and Champion.

Drilling by Conoco, reported in a May 10, 1979 internal report, included a significant interval of chalcopyrite and molybdenite mineralization in drill-hole MN-42, drilled in 1977, intersecting 1,020 ft. (311m) of 0.41% copper, 0.012% molybdenum, 4.5 ppm silver, and 0.1 ppm gold from 560 ft. (171 m) to 1,580 feet (482 m) (true width unknown) at the Copper Queen prospect, located approximately 2 mi. (3 km) west of the Longshot Ridge prospect (see details below).

Conoco reported a 142 million tons (129 million tonnes) inferred resource grading 0.35% copper, 0.015% molybdenum, 0.1% Zn, 4 ppm silver, and 0.1 ppm gold for the Copper Queen deposit in the internal report dated May 10, 1979. In another internal report completed on September 20, 1979, Conoco reported “possible reserves from drill-hole data and geologic interpretation on cross sections” of 13.2 million tons (11.0 million tonnes) grading 0.55% copper for the Longshot Ridge prospect. These are a historic resource before the implementation of NI 43-101 and CIM Standards. Emergent's geologists have not verified the calculations or attempted to reclassify them according to current standards.

In a 2010 Technical Report, Searchlight defined a historic indicated resource of 16.3 million tons (14.8 million tonnes) of 0.43% copper and an historic inferred resource of 2.9 million tons (2.6 million tonnes) of 0.31% copper in the Longshot Ridge copper oxide skarn area was defined. A cut-off grade of 0.20% copper was used. This resource is being treated as a historic resource by Emergent's geologists and no work has been done to verify the calculations or update them to treat the resource as current.

The exploration targets on the north part of the Property abut the historic The Santa Fe deposit was discovered in the late 1970’s and mined by Corona Gold in the late 1980’s and early 1990’s. Historic production estimated from Santa Fe Mine is 345,499 ounces of gold and 710,629 ounces of silver between 1989 and 1995 (see details below).

New York Canyon therefore hosts near surface copper oxide skarn exploration targets, deeper copper/molybdenum porphyry exploration targets, and may also host gold-silver exploration targets. Under the terms of the Earn-in with Option to Joint Venture Agreement, KEX plans to conduct exploration on the Property and is in charge of defining and implementing exploration programs and budgets to meet their expenditure requirements.

New York Canyon Property

Looking East

LOCATION & OWNERSHIP

The Property is located in the Santa Fe Mining District, Mineral County, in west-central Nevada, about 30 mi. (48 km) from Hawthorne, Nevada. The Property has synergy with Emergent's other properties in the Walker Lane structural trend on the western side of Nevada and locational synergy with Emergent's Mindora Property that is located 12 miles west..

The Property was originally optioned by Emgold from Searchlight Resources Corporation (TSXV: SCLT) (“Searchlight”) (see May 28, 2019 and July 16, 2019 press releases). At the time, the Property consisted of 21 patented claims and 60 unpatented claims totaling about 1,500 ac. (607 ha). The claims are divided into two groups – the North and South Groups.

The North Group of claims on the Property cover historic past producing copper workings and gold occurrences and is adjacent to the past producing Santa Fe Gold Mine owned by Victoria Gold Corporation (TSX:V: VIT) (“Victoria Gold”) The Santa Fe deposit was discovered in the late 1970’s and mined by Corona Gold in the late 1980’s and early 1990’s. Historic production estimated from Santa Fe Mine is 345,499 ounces of gold and 710,629 ounces of silver between 1989 and 1995 (source: The Nevada Mineral Industry, Special Publication MI-2017, Nevada Bureau of Mines and Geology). Note that the vicinity of the Property to a past producing mine is not necessarily indicative of the mineralization that may be hosted at New York Canyon Property.

The South Group of claims comprising the Property hosts the Longshot Ridge, Champion, and Copper Queen deposits, which includes copper skarn oxide, copper skarn sulfide, and copper sulfide porphyry mineralization.

Emgold agreed to purchase a 100 percent interest in the claims comprising the Property from Searchlight under the following terms:

- C$10,000 on signing the LOI (paid);

- C$40,000 on closing of the Transaction (paid);

- C$500,000 in common shares of the capital of Emgold at the date of closing, with the share price based on the 30-day volume weighted average price of the Company’s share immediately prior to the announcement of the Transaction (issued);

- C$100,000 within 6 months of the date of closing of the Transaction (paid*);

- C$100,000 within 12 months of the date of closing of the Transaction (paid*); and

- C$100,000 within 18 months of the date of closing of the Transaction (paid*).

*Note that Emgold had an option to make a reduced payment of C$225,000 in lieu of the three x C$100,000 payments. The C$225,000 payment had to be made before the 6 month anniversary of the Emgold-Searchlight Agreement. Emgold subsequently completed an Earn-in with Option to Joint Venture Agreement with Kennecott. Kennecott paid the C$225,000, on behalf of Emgold, as part of their expenditures under the Emgold-Kennecott Agreement.

On November 15, 2019, Emgold announced it had increased the size of the Property by staking and additional 92 unpatented claims.

On February 11, 2020, Emgold announced it had signed an Earn-in with Option to Joint Venture Agreement with Kennecott. Key points of the agreement include:

- Kennecott will have an option (the “First Option”) to acquire a 55% undivided interest in the Property by incurring US$5.0 million in expenditures over a 5 year period, of which US$1.0 million is a required expenditure that must be completed prior to the 18 month anniversary of the Agreement.

- Kennecott will have a second option (the “Second Option”) to earn an additional 10% undivided interest in the Property (for a total of 65%) by incurring an additional US$7.5 million in expenditures over a 3 years period.

- Kennecott will have a third option (the “Third Option”) to earn an additional 10% undivided interest in the Property (for a total of 75%) by incurring an additional US$10 million in expenditures over a three year period.

- Any expenditure in excess of an option expenditure requirement in a given time period will be credited against subsequent option expenditure requirements. Kennecott may, at any time or from time to time, accelerate its satisfaction of the First, Second, or Third Option by paying Emgold money in lieu of incurring expenditures.

- While earning in, Kennecott will have the right to make exploration and development decisions.

- Kennecott must maintain the Property in good standing during the option period(s), including payment of BLM and County maintenance fees and any underlying property payments due to Searchlight Resource Corporation. As described above Emgold had an underlying agreement to acquire a 100 percent interest in the Property from Searchlight, which required three remaining payments over an 18 month period totaling CDN$300,000. Emgold had an option to reduce this payment to C$225,000 as described above.

- Kennecott will have the right to elect to form a joint venture (the “Joint Venture”) with Emgold upon completion of either the First, Second, or Third Option. Upon establishing a Joint Venture each participant will fund the joint venture according to its participating interest, with Kennecott acting as the Manager of the joint venture. If a party’s participating interest falls below 10%, then such parties participating interest will be converted to a 1% Net Smelter Royalty, capped at US$25 million.

On March 30, 2020, Emgold announced it completed its option and had acquired a 100% interest in the 21 patented claims and 60 unpatented claims from Searchlight. Including the 92 claims staked by Emgold and the 265 claims staked by Kennecott, the current size of the property is 21 patented claims and 417 unpatented claims.

New York Canyon Property

Location Map

GEOLOGY & MINERALIZATION

The Property lies within the central portion of the Walker Lane structural belt, a broad zone of NW-SE striking parallel to sub-parallel right lateral strike-slip faults extending for more than 400 miles through western Nevada and into northern and southern California. The structural belt was initiated during the Jurassic period at which time a number of porphyry copper deposits and related skarn deposits were formed. Volcanism and related hydrothermal mineralization, often of Tertiary age, are recognized along the length of this structural trend.

Copper mineralization is hosted primarily within the Triassic-age Gabbs Formation limestone sequence and within the underlying Triassic-age Luning Formation limestone units and overlying Jurassic-age Sunrise Formations limestone sequence. Mineralization in skarns is adjacent to Cretaceous age felsic intrusive rocks. Non-mineralized volcanic flows of Tertiary-age cover these older rocks on the hills and Quaternary–age alluvium and colluvium cover them in the valleys.

Mineralization is associated with three principal occurrences – Copper Queen on the west, Champion on the center, and Longshot Ridge on the east side of the claims. The copper occurrences lie along a west-northwest trend that likely reflects the deeper basement structures.

New York Canyon

Main Deposits and Structures

The Copper Queen prospect has no exposed mineralization at the surface but contains copper sulfide skarn at depth and an incompletely confirmed copper-molybdenum sulfide porphyry system at greater depth. The Champion and Longshot Ridge prospects, however, have numerous widespread exposures of copper skarn mineralization, both in surface outcrop and in old mine workings. The majority of recent exploration efforts on the Property have focused on the extensive oxide copper skarn mineralization at Longshot Ridge. The principal alteration and mineralization at Longshot Ridge occurs as copper-rich skarn in porous and permeable zones within sedimentary rock units of the Luning, Gabbs and Sunrise Formations. Additionally, small amounts of copper mineralization occur in stockwork veinlets in permeable fractures in some of the porphyritic intrusive sills and dikes that intrude the sedimentary rock units. The alteration associated with mineralization in these intrusive bodies consists of argillization, phyllic, and silicification – typical for this type of rock.

At Longshot Ridge, the oxide copper minerals are apparently the products of supergene weathering and oxidation of primary copper sulfide minerals present in the original skarn. The copper mineralization consists almost entirely of secondary copper minerals, principally malachite, azurite, chrysocolla and copper wad. Additionally, some copper-rich limonite (goethite) is reported, and a fairly common greenish alteration mineral is thought to be a zinc bearing clay. Because limestones tend to buffer solutions carrying copper in a supergene environment, copper weathered from the skarn sulfide minerals migrates to the non-skarn limestone units where it may be enriched as much as 300 to 400 percent.

New York Canyon Property

Oxidized Mineralization at Longshot Ridge

EXPLORATION

The discovery of these deposits dates back to 1875 and historic production, by the Wall Street Copper Company during 1906-1929, came from a number of small surface showings in the Longshot Ridge area. Historic production is reported to be 8.9 million pounds (4.04 million kg) of copper at an average grade of 5.5% (source: USGS Mineral Resource Data System, Deposit ID 10301559, New York Canyon / Longshot Ridge Project).

In the mid-1960s to the late-1970s, several companies explored the Property for major copper porphyry deposits. This work defined additional copper oxide skarn mineralization at Longshot Ridge and copper sulfide skarn and porphyry mineralization at the Copper Queen prospects. Historic drilling by Conoco, the operator of the Property from 1977 to 1991, totaled 107 holes totaling approximately 98,433 ft. (30,000 m).

Drilling by Conoco, reported in a May 10, 1979 internal report, included a significant interval of chalcopyrite and molybdenite mineralization in drill-hole MN-42, drilled in 1977, intersecting 1,020 ft. (311m) of 0.41% copper, 0.012% molybdenum, 4.5 ppm silver, and 0.1 ppm gold from 560 ft. (171 m) to 1,580 ft. (482 m) (true width unknown) at the Copper Queen prospect, located approximately 2 mi. (3 km) west of the Longshot Ridge prospect.

Between 1992 and 1997 Kookaburra Resources Ltd. (“Kookaburra”) conducted further exploration, including exploration with various joint venture partners, including Coca Mines and Phelps Dodge. They tested the Longshot Ridge and Copper Queen skarns with an additional 54 drill-holes totaling 13,018 ft. (3,968 m). The primary goal of this exploration was to increase the size of the oxide skarn resource.

Subsequent to Kookaburra’s work on the Property, the unpatented claims lapsed in 1999. New unpatented claims were staked by two individuals and subsequently acquired by Nevada Sunrise LLC (“Nevada Sunrise”), a privately held Nevada corporation, along with rights to acquire the patented claims.

Aberdene Mines Ltd. (subsequently Canyon Copper Corporation and then Searchlight Resources Incorporated) acquired an option on the Property from Nevada Sunrise in March, 2004 and subsequently acquired rights to both the patented and unpatented claims that make up the current Property. Searchlight completed 27,605 ft. (8,414 m) of drilling in 73 holes, focused on the Longshot Ridge deposit.

Total historic drilling on the Property to date is therefore 234 holes totaling 139,056 ft. (43,384 m). No drilling on the Property has been done since 2006. Searchlight completed a NI 43-101 Technical Report on the Longshot Ridge Project in 2010, including a resource estimate. This Technical Report includes drilling to 2005 and excluded drilling done in 2006.

New York Canyon Property

2006 Drilling Program

QA/QC procedures on historic work are unknown and work was completed prior to the implementation of NI 43-101 Standards of Disclosure and CIM Standards. Work was completed by reputable companies and it is expected industry standards were followed.

Work done by Searchlight was done after the implementation of NI 43-101 Standards of Disclosure and CIM Standards. Sampling methods, analysis, and security of samples for their work is detailed in the 2010 Technical Report completed by Searchlight.

In completing the 2010 Technical Report, it was noted that during the 2006 drill program there was a change in laboratories part way through the drilling program. The labs used a different set of procedures for sample preparation and copper analysis. The check-assay system identified a variation in sample results between the labs, including analysis of sample blanks. It was recommended that re-assays be done at a third party lab and the 2006 drill data was not used in the 2010 resource estimate. The 2006 drill program included 7 HQ sized diamond drill holes totaling 2,805 ft. (855 m) and 26 RC holes totaling 8,828 ft. (2,688 m).

Historic work on the Property includes induced polarization (IP), ground magnetic (GMAG), and gravity (GRAV) surveys spanning from the mid-1960’s to 2004. In 2006, Wright Geophysics reviewed the historic data and completed new GMAG and IP studies.

Several historic resource estimates were done. Conoco reported a 142 million tons (129 million tonnes) inferred resource grading 0.35% copper, 0.015% molybdenum, 0.1% Zn, 4 ppm silver, and 0.1 ppm gold for the Copper Queen deposit in the internal report dated May 10, 1979. In another internal report completed on September 20, 1979, Conoco reported “possible reserves from drill-hole data and geologic interpretation on cross sections” of 13.2 million tons (11.0 million tonnes) grading 0.55% copper for the Longshot Ridge prospect. These are historical reserve and resource estimates prepared prior to the implementation of NI 43-101 and use terminology not compliant with current reporting standards. A qualified person has not audited or verified these historical estimates nor made any attempt to re-classify the estimates according to current NI 43-101 Standards of Disclosure or the CIM standards.

In a 2010 Technical Report, Searchlight defined a historic indicated resource of 16.3 million tons (14.8 million tonnes) of 0.43% copper and an historic inferred resource of 2.9 million tons (2.6 million tonnes) of 0.31% copper in the Longshot Ridge copper oxide skarn area. A cut-off grade of 0.20% copper was used. This mineral resource estimate is considered historical as defined by NI 43-101 and a qualified person has not audited or verified this resource as a current mineral resource. A qualified person has not done sufficient work to classify the historical estimate as current mineral resources or mineral reserves. The Company is not treating the historical estimate as current mineral resources or mineral reserves.

The historic Searchlight mineral resource for Longshot Ridge was estimated using industry standards that conformed with CIM Definition Standards on Mineral Resources and Mineral Reserves. The mineral resource estimate database contains 58 historic drill holes from prior operators to Searchlight totaling 18,469 feet, 38 drill holes (10 HQ diamond drill holes and 28 reverse circular drill holes) totaling 14,585 feet completed by Searchlight during the period from 2004 to 2005, and various surface and trench samples from 34 trenches and road cuts obtained from Longshot Ridge. The estimate does not include 33 drill holes (7 HQ diamond drill holes and 26 reverse circulation holes) completed by the Company in 2006.

Outlier high copper assays were capped at 4% Cu within the mineralized solid and at 1.3% Cu if outside the solid. Uniform 20 ft. composites were produced both inside and outside the mineralized solid from capped Cu values. Semivariograms were produced for Cu inside and outside the mineralized solid and used both to estimate and classify the resource. A three-dimensional geological and block model was generated using Gemcom and Techbase software. A block model with blocks of 50 x 50 x 40 feet in dimensions was placed over the mineralized solid with the percentage below topography and inside the mineralized solid recorded in each block. Densities of 2.94 for the mineralized zone and 2.70 outside the mineralized zone were used. Copper grades were interpolated into all blocks by using an ordinary kriging estimation method. Blocks were classified as either indicated or inferred based on grade continuity quantified by the semivariogram.

To upgrade the historic resource to current, it was recommended that drilling by Searchlight from 2006 be re-assayed due to QA/QC issues identified in the 2010 Technical Report and the new data be incorporated into the resource model.

Both Conoco and Kookaburra conducted metallurgical tests including included alkaline and acid bottle roll leaching and flotation. Conoco’s work focused on the Copper Queen sulfide mineralization while Kookaburra focused on the copper oxide mineralization at Longshot Ridge.

In 2005, McClelland Labs conducted specific gravity tests on 10 Longshot Ridge core samples from one drill hole. These tests are not considered to be representative of the deposit because they came from a single hole. In 2007, SGS Lakefield Research conducted various metallurgical tests to determine the best methods to recover copper at Longshot Ridge. They concluded acid leaching showed the greatest recoveries, but acid consumption was high. Additional test work is needed to optimize metallurgical recovery and that more samples are needed to be more representative of the deposit.

TECHNICAL REPORT

No Technical Report has yet been completed for the Property.

QUALIFICATIONS

Mr. Robert Pease, CPG, acting as the Qualified Person for Emgold, has reviewed and approved the information on this webpage.

REFERENCES

Bollig, D.W. and Robinson, R.H. Initial Mining Costs Estimated tor Long Shot Ridge, Santa Fe Mining District, Mineral County, Nevada, Conoco Inc., Minerals Department, September 20, 1979

Broili, Chris; Klohn, Mel; and Giroux, Garry, Technical Report on the New York Canyon Copper Project, Nevada USA, Prepared for Canyon Copper Corp., April 6, 2010

Cowdery, P.H., Technical Report on the Longshot Ridge Copper Oxide Project, Core Engineering Associates for Kookaburra Resources Ltd., April 1993, April 23, 1993, revised June 23, 1993

Long, Roney C., Progress Report for the Copper Queen Area, New Your Canyon Project, Continental Oil Company Minerals Department, May 10, 1979

DISCLAIMER

Readers are cautioned to review the Disclaimer Page on this website for qualifications that may be applicable to the information contained on this Property Page, including forward looking statements, definitions of mineral resources and reserves, etc. Readers are also cautions to review Emergent's financial statements and management’s discussion and analysis available on this website or at www.sedar.com for additional information.