| Location | Nevada |

| Location Details | 20 mi SE of Hawthorne |

| Type of Project | Early stage exploration |

| Number of Claims | 30 unpatented claims |

| Est. Property Size | 600 ac |

| Emgold Ownership | Acquisition of 100% interest in progress |

| Underlying Royalties | US$20,000 advance minimum royalty on 18 claims and 2% NSR production royalty, half of which can be acquired for US$200,000 prior to the 5th year of the agreement or US$500,000 between the fifth and ninth anniversary of the agreement |

| Exploration Completed | · Soil and rock chip sampling

· Trenching · Underground sampling · Geophysics · 174 drill holes totaling 42,836 ft. drilled between 1979 to 1995 · Metallurgical studies · Scoping studies |

| Key Exploration Targets | · Near surface high grade Au/Ag target

· Larger bulk disseminated Au/Ag target · Mo/Cu porphyry system at depth |

| Technical Report | None |

| Resources | Historic resources only |

| Highlights | Historic work by others shows a conceptual high grade target of 30,000 to 60,000 oz. @ 0.05-0.1 opt AuEq. Potential also exists for a larger bulk disseminated target similar to the nearby past producing Santa Fe Mine (e.g. 300,000 – 500,000 oz. AuEq target). Historic drilling also encountered Mo mineralization below the Au/Ag and potential exists for a large Mo/Cu porphyry system at depth. |

Emgold is in the process of acquiring 100% ownership in the Mindora Property, NV. Mindora is an advanced stage gold, silver, and base metal exploration property located about 20 miles east of Hawthorne, NV. It consists of 30 contiguous unpatented lode mineral claims covering about 600 acres. It was explored in the 1980’s and 1990’s for gold and silver mineralization, searching for a deposit similar to the nearby historic Santa Fe Gold Mine that produced over 345,000 ounces of gold and 710,000 ounces of silver between 1989 and 1995. Drilling also resulted in discovery of molybdenum porphyry mineralization at depth and surface sampling discovered copper skarn and porphyry mineralization on surface that has yet to be adequately drill tested. Over 43,000 feet of historic drilling has been conducted on the property to date.

SUMMARY

On May 21, 2018, Emgold announced it had signed a Letter of Intent with Nevada Sunrise LLC, a private Nevada company, giving it the right to purchase 12 unpatented mining (the “NS Claims”). The Company has also signed a separte Letter of Intent with BL Exploration LLC, also a private Nevada company, giving it the right to purchase 18 unpatented mining claims (the “BL Claims”). Together, the 30 unpatented mining claims make up the Mindora Property (the “Property”). The Property is an advanced stage gold, silver, and base metal exploration property that was explored in the 1980’s and 1990’s. The Property hosts near surface gold and silver mineralization, and deeper molybdenum porphyry mineralization has been drilled at depth.

Examples of significant intercepts from historic drilling on the property include:

- 105 ft. (32.0 m) of 0.057 opt (1.94 gpt) gold and 3.552 opt (121.78 gpt) silver in hole #7, representing a 0.098 opt (3.36 gpt) AuEq grade from a hole depth of 0 to 105 ft. (0 to 32.0 m), with true width of intercept unknown (AuEq grade based on US$1,300 per oz. gold price and US$15 per oz. silver price, with no adjustment for recovery); and

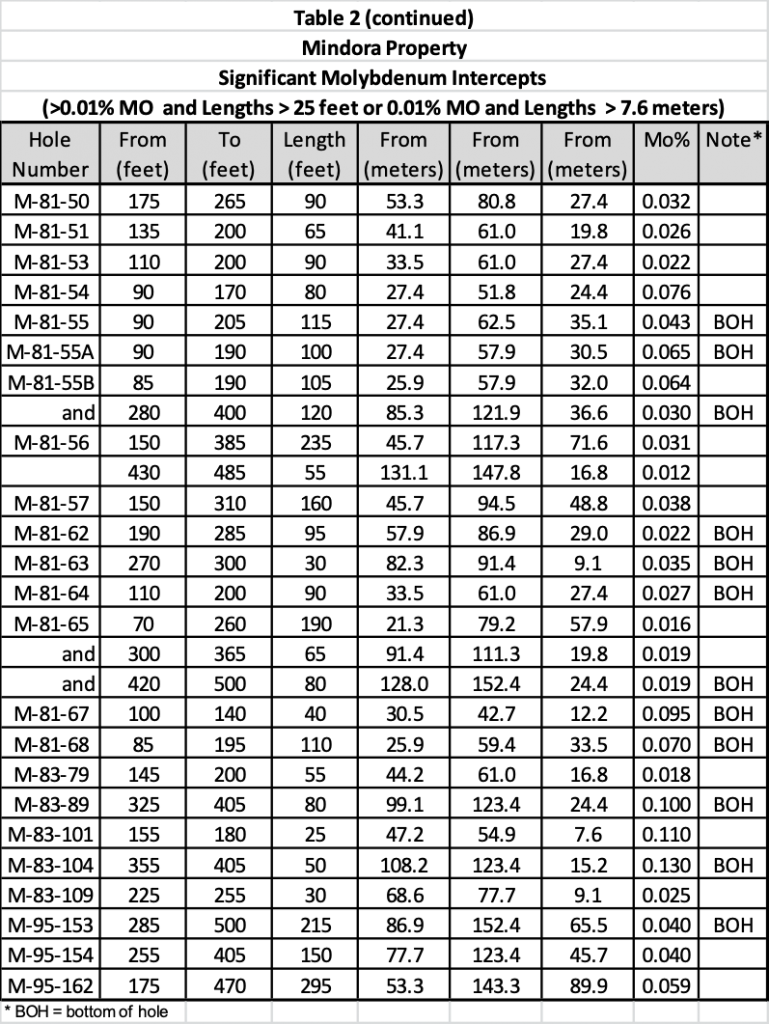

- Hole No. 162 with 295 ft. (90 m) of 0.59% Mo from a hole depth of 175 to 470 feet, with true width of intercept unknown.

The exploration targets at Mindora include:

- A near surface higher grade gold and silver resource (target 30,000-50,000 oz. at >0.75 AuEq opt) that may have potential to be mined by open pit methods with offsite processing;

- A larger lower grade gold-silver resource (target 0.5M -1M oz >0.03 opt AuEQ) that represents a larger bulk disseminated deposit, similar to the nearby historic Santa Fe Mine, that has potential to be mined using open pit methods with on-site processing; and

- Deeper molybdenum and copper targets that my result in development of resources that have potential for open pit or underground mining with onsite processing.

Note that there are currently no mineral resources or mining reserves yet defined at Mindora that meet NI 43-101 Standards for Disclosure or CIM Standards and these are targets only. Additional exploration is needed to develop resources and ultimately mineral reserves.

Note that the location of the Property in the vicinity of the Rawhide Mine and other nearby exploration properties does not mean that a resource will be identified on the Property. However, the presence of similar geology and mineralized structures to those on the Buckskin Rawhide East and Rawhide Properties are favorable indicators for the potential of discovery.

Mindora

Location Map

Terms of the Nevada Sunrise LLC Transaction

Emgold has agreed to purchase a 100 percent interest in the 12 unpatented mining claims, the NS Claims, from Nevada Sunrise LLC, under the following terms:

- US$50,000 on closing; and

- US$25,000 per year on the anniversary date of the closing for a period of four years, for a total purchase price of US$150,000.

Terms of the BL Exploration LLC Transaction

Emgold has agreed to purchase a 100 percent interest in 18 unpatented mining from BL Exploration LLC for US$50,000, due at closing. The BL Claims will be subject to a US$20,000 per year advance royalty. Emgold will assign a 2% NSR royalty to BL Exploration. Emgold will have the option of acquiring one-half of the 2% NSR for US$200,000 on or before the fifth anniversary of the closing of the transaction. Should Emgold not exercise this option, it will have a second option of acquiring ½ of the 2% NSR for US$500,000 after the fifth anniversary and before the ninth anniversary of the closing of the transaction.

Both the Nevada Sunrise LLC and BL Exploration LLC transactions are subject, amongst other conditions, to completion of a definitive agreement and regulatory approval by the TSX Venture Exchange.

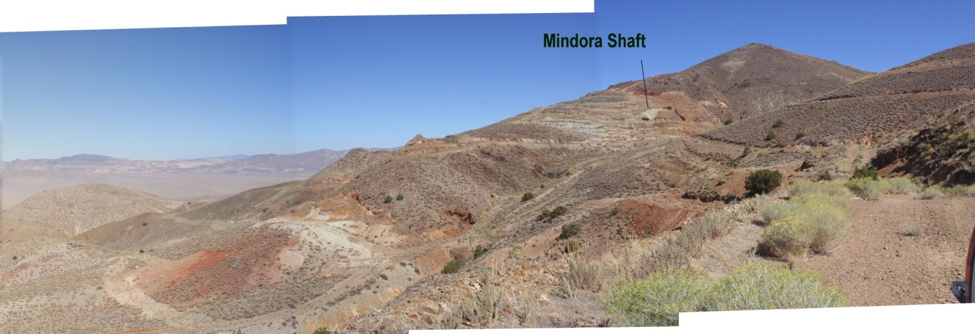

Mindora

Looking East

LOCATION AND OWNERSHIP

Location and Ownership

The Property is a gold, silver, and base metal property located 20 miles southeast of Hawthorne, in the Garfield Hills, Mineral County, Nevada. Emgold has signed two Letters of Intent to consolidate 30 contiguous unpatented mining claims that make up the Property. The Property has regional synergy with Emergent's other properties in the Walker Lane structural trend in western Nevada and locational synergy with the New York Canyon Property that Emgold is also in the process of acquiring approximately 14 mi. distance.

Terms of the Nevada Sunrise LLC Transaction

Emgold has agreed to purchase a 100 percent interest in the 12 unpatented mining claims, the NS Claims, from Nevada Sunrise LLC, under the following terms:

- US$50,000 on closing; and

- US$25,000 per year on the anniversary date of the closing for a period of four years, for a total purchase price of US$150,000.

Terms of the BL Exploration LLC Transaction

Emgold has agreed to purchase a 100 percent interest in 18 unpatented mining from BL Exploration LLC for US$50,000, due at closing. The BL Claims will be subject to a US$20,000 per year advance royalty. Emgold will assign a 2% NSR royalty to BL Exploration. Emgold will have the option of acquiring one-half of the 2% NSR for US$200,000 on or before the fifth anniversary of the closing of the transaction. Should Emgold not exercise this option, it will have a second option of acquiring ½ of the 2% NSR for US$500,000 after the fifth anniversary and before the ninth anniversary of the closing of the transaction.

Both the Nevada Sunrise LLC and BL Exploration LLC transactions are subject, amongst other conditions, to completion of a definitive agreement and regulatory approval by the TSX Venture Exchange.

HISTORY

The Property was discovered and worked in the late 1800’s. In the 1920’s with a limited amount of production came from a series of rich, silver-bearing veins. During the period 1946-1948, an estimated 10,000 tons of direct-shipping ore was mined from the Property at unknown grade.

In the 1970’s, geologists recognized the epithermal nature of mineralization, and similarities to the nearby Santa Fe deposit and other carbonate-rich sediment-hosted gold deposits in Nevada. The Santa Fe deposit was discovered in the late 1970’s and mined by Corona Gold in the late 1980’s and early 1990’s. Historic production estimated from Santa Fe Mine is 345,499 ounces of gold and 710,629 ounces of silver between 1989 and 1995 (source: The Nevada Mineral Industry, Special Publication MI-2017, Nevada Bureau of Mines and Geology). Note that the vicinity of the Property to a past producing mine is not necessarily indicative of the mineralization that may be hosted at Property. The historic Santa Fe Gold Mine is now owned by Victoria Gold Corporation (TSX:V: VIT) (“Victoria Gold”) and is in a reclamation phase.

Several companies staked the property during this period, did limited sampling and geophysics, and then dropped their claims. Hawthorne Gold Corporation acquired the property in 1979, and in the following year, brought in E & B Exploration Inc. as a joint-venture partner and operator. E & B completed programs of rock-chip sampling and trench sampling, surface and underground mapping, geophysical surveys, and drilled approximately 31,425 ft. (9,578 m) in 134 holes (including a water-well and two diamond core holes). E & B’s work developed four known mineralized zones.

Eureka Resources, Inc. acquired E & B’s interest in 1983. Eureka conducted IP, magnetic and VLF electromagnetic surveys, soil and rock-chip sampling and drilled an additional approximately 11,441 ft. (3,487 m) in 40 holes. In 1988, Eureka commissioned metallurgical studies and a detailed review by Kilborn Engineering with the goal of developing a small open pit gold mine.

Eureka failed to file assessment work on the claims in 2001 and Nevada Sunrise LLC and BL Exploration staked the Property in 2001 and 2003, resulting in the current land package of the NS and BL Claims, respectively. Little exploration work has been done on the property since the last drilling program, completed in 1995.

GEOLOGY AND MINERALIZATION

Limestone and intermediate volcanic rocks of the Triassic Luning Formation underlie the east and central portions of the Property. Quartz rhyolite and quartz latite dikes and sills, and altered granodiorite, intrude the meta-sedimentary and metavolcanic rocks. Late Tertiary volcanic rocks and overburden cover the western portion of the Property.

The gold-silver zone is an epithermal, carbonate-hosted, structurally controlled deposit in the Luning Limestone Formation. Many of the shallow holes testing near-surface gold-silver mineralization intercepted and bottomed in an extensive molybdenum stockwork system. The molybdenum is related to quartz latite and quartz porphyry dikes. The extent of the molybdenum system is not known. There is also evidence of copper skarn and copper porphyry mineralization on the Property from surface sampling, but no drilling has been done to test these targets. The dominant structures are northeast trending faults secondary structures are northwest trending Walker Lane related faults.

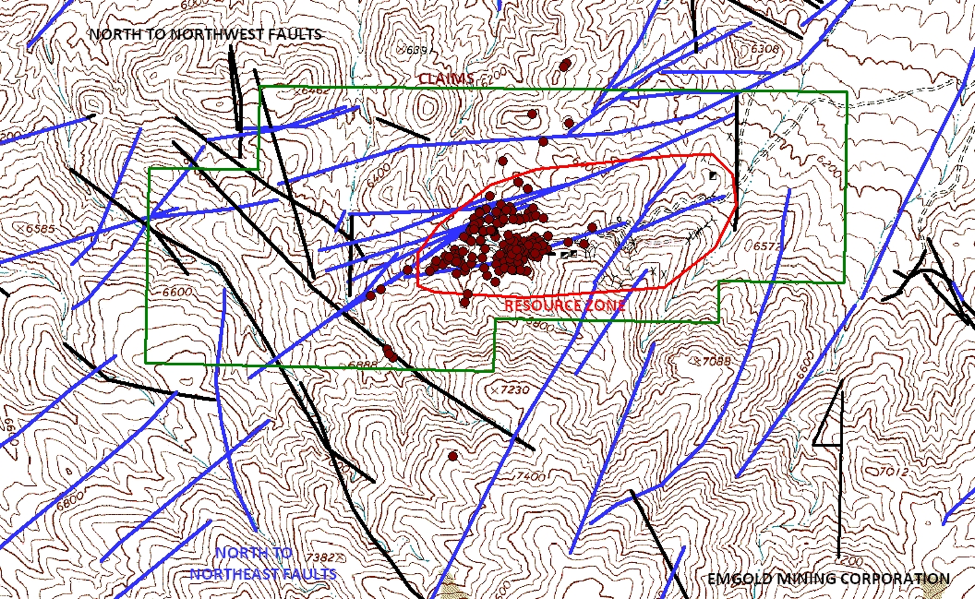

Mindora Property

Claim Map, Drill Hole Locations, Structures, and Mineralized Zone

(no scale)

Geochemistry

Soil sampling, rock sampling, and trenching have been done on the Property.

Geophysics

According to internal Hawthorne Gold Corporation summary reporting (1984), historic geophysical survey completed on the Property include a 2.5 line-mile induced polarization survey (1974), a 5 line-mile VLF-EM survey (1978), 10 line-mile VLF-EM survey (1983) and a 10 line-mile ground magnetometer survey (1983). An induced polarization study was later conducted in 1995. No modern geophysics has been completed and will be a priority for exploration.

Drilling

Total drilling on the Property is about 42,836 ft., mostly in vertical holes in the range of 200-300 ft. Average depth is 250 ft. and maximum drilling depth of 700 ft. (214 m).

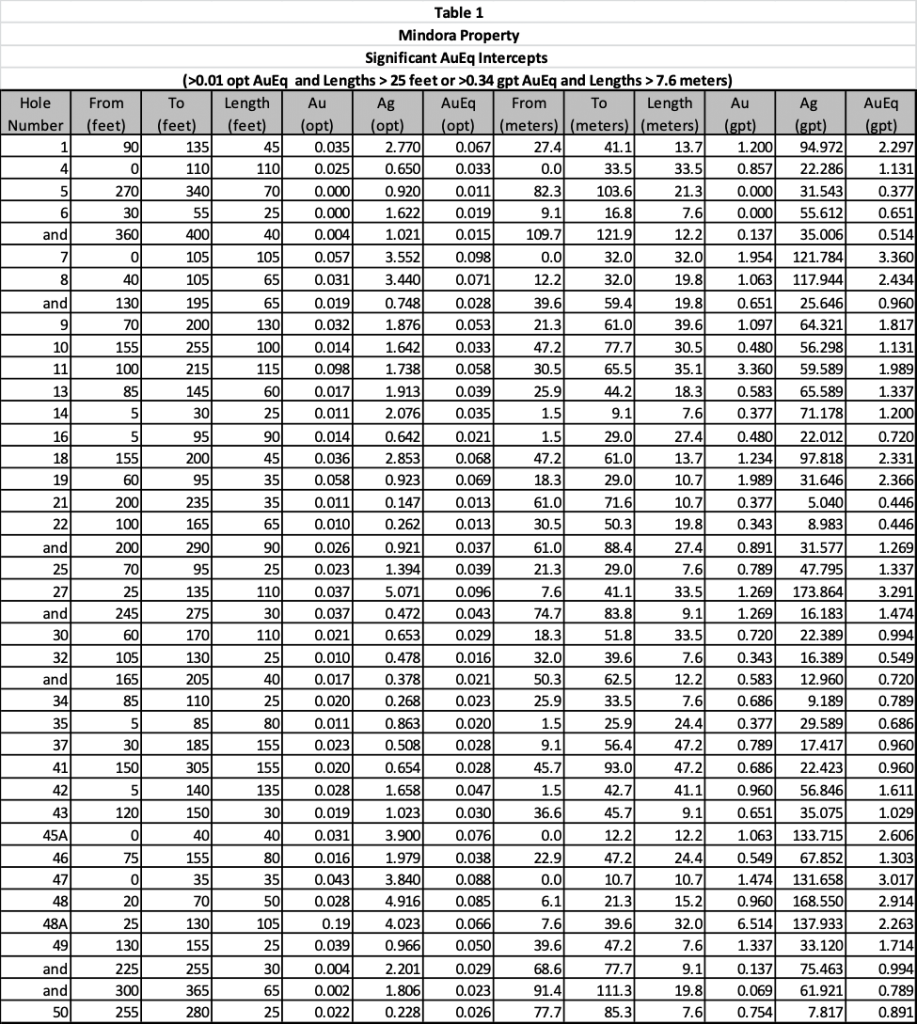

From the historic data, Emgold has summarized a list of significant gold and silver intercepts, as shown in Table 1. This table contains drill intercepts with gold grades greater than 0.01 opt (0.34 g/t) AuEq and lengths greater than 25 ft. (7.6 m). A gold price of $1,300 per ounce and a silver price of $15 per ounce were used to calculate gold equivalent grades, at a ratio of 86.7, with no allowance for metallurgical recovery. True widths of intercepts are unknown.

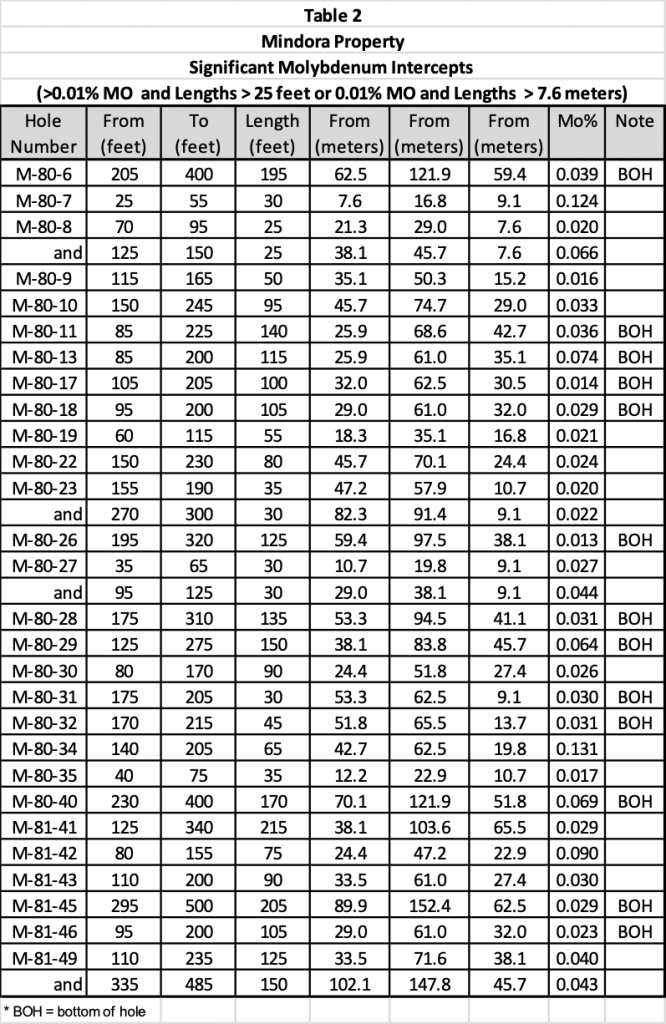

Emgold has also summarized a list of significant molybdenum intercepts, as shown in Table 2. This table contains drill intercepts with greater than 0.01% Mo and lengths greater than 25 ft. (7.6 m). Note that many holes bottomed in molybdenum mineralization. The longest intercept was 295 ft. (90 m) of 0.59% Mo from in drill-hole 162. True widths of intercepts are unknown.

Data in Tables 1 and 2 is from a time prior to the implementation of NI 43-101 Standards of Disclosure and CIM Standards. QA/QC procedures have not been reviewed by Emergent's geologists.

There is little assay information on copper mineralization on the Property. A report titled “Assessment Report on the Mindora Property, Mineral County, Nevada for Eureka Resource Inc.” by Myra Schatten, B.C., dated April, 1993, described copper mineralization on the Property. The report identified several copper anomalies. It concluded that copper mineralization occurs as skarns along the contact between the intrusives and the limestone and sediments, as replacement zones adjacent to intrusive and limestone sedimentary contacts, and as porphyry mineralization.

EMERGENT’S QUALITY ASSURANCE AND QUALITY CONTROL PROGRAM

The data available on the Property was generated through exploration prior to the implementation of National Instrument NI 43-101 and CIM Standards. This data is historical in nature and Emgold has not yet completed sufficient work to independently verify these historic results, therefore they should not be relied upon. There is, however, sufficient data available to create a 3-Dimensional model of the historic data to ultimately use to guide future exploration.

Resources and Reserves

Several resource estimates were done by various companies working on the Property between 1981 and 1988. Eureka evaluated a small open pit mine in 1998 based on a historic resource of 1.04M tons (0.9M tonnes) averaging 0.037 opt (1.16 gpt) gold and 1.78 opt (55.63 gpt) Ag = 0.058 opt (1.81 g/t) AuEq containing 58,800 AuEq ounces.

This is a historical estimate prepared before the implementation of NI 43-101 and uses terminology not compliant with current reporting standards. A qualified person has not audited or verified this estimate nor made any attempt to re-classify the estimate according to NI 43-101 Standards of Disclosure or the CIM Standards. There are currently no mineral resources or reserves defined on the Property that meet NI 43-101 or CIM disclosure standards.

Metallurgy

Metallurgical work completed by several laboratories in the 1980’s indicated potential recoveries of >90% for gold and 75-80% silver for milled ore and 70-75% for gold and 45-50% for silver for crushed leached ore.

Permitting and Environmental

Emgold will have to apply for exploration permits for any exploration work on the Property. There are no environmental liabilities on the Property.

Conclusions

The Mindora Project is has an extensive database of information including 43,000 feet of historic drilling. There are multiple exploration targets that have been identified including near surface gold and deeper molybdenum porphyry mineralization. Copper porphyry mineralization may also be present. The initial path forward will be to review the historic data base and create a new 3-D exploration model from available data. Subsequently, exploration will be done to confirm historic drill results. This can be quickly followed by drilling for resource generation.

Qualification

Emergent's Qualified Person, Mr. Robert Pease CPG, consulting geologist for the Company, has reviewed and approved the scientific and technical information on this webpage.

References

Campbell, E.V., Summary Report on the Luning Project, January 1989

Ernesco Resources, Mindora Project, February 4, 1985

Kerr, J.R., Summary Reprot on the Mindora Property for Hawthorne Gold Corporation, December 1984.

Lackey, Larry, Summary Report on the Mindora Project, April 6, 2016

KIlborn Engineering, Mindory Project Sudy, Hawthorne Nevada, June 1988

Schatten, Myra, Assessment Report on the Mindora Property, Mineral County, Nevada, April 1993

Disclaimer

Readers are cautioned to review the Disclaimer Page on this website for qualifications that may be applicable to the information contained on this Project Page, including Forward Looking Stateme