| Location | Quebec |

| Location Details | 80 km south of La Sarre or 105 km WSW of Matagami |

| Type of Project | Early stage exploration |

| Number of Claims | 180 |

| Est. Property Size | 10,061 ha |

| Emgold Ownership | 100% |

| Underlying Royalties | 1.5% NSR of with 0.5% can be purchased by Emgold for C$500,000 |

| Exploration Completed | · Soil and rock chip sampling

· Geophysics · 119 drill holes totaling 22,990m of diamond drilling by various operators between 1959 and 2018 · 206 RC drill holes in glacial till by various operators to guide exploration · 3,021m of diamond drilling in 8 drill holes by Emgold in 2019 |

| Key Exploration Targets | Kama Trend, Central Till Anomaly, Northwest Anomaly |

| Technical Report | NI 43-101 Technical Report, Casa South Property, NTS 32E06/32E11, Northwestern Quebec, Demers and Theberge, March 8, 2019 |

| Resources | None yet defined |

| Highlights | Located south and adjacent to Hecla Mining Corporations operating Casa Berardi Mine. Casa Berardi Mine has produced over 2 million ounces since 1988 and has production of over 160,000 oz of gold in 2018. 3,000m of drilling completed in 2019 with assays pending. |

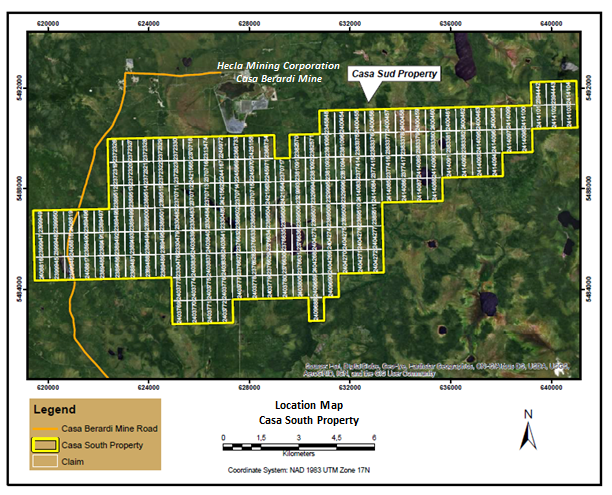

Emgold has a 100% interest in the Casa South Property, QC, subject to a 1.5% Net Smelter Royalty. The Property comprises 180 active mining titles covering a total of 10,061 hectares (100 square kilometers). It extends immediately south of Hecla Mining Corporation’s Casa Berardi Mine operation and extends laterally for 20 kilometers covering different sub-parallel structures corresponding to a distinct geophysical signatures and hosting elevated gold values in soil anomalies. Casa Berardi Mine has produced approximately 2.5 million recovered gold ounces since commencing production in 1988 to the end of 2018. (Source: Technical Report for the Casa Berardi Mine, Northwestern Quebec, Canada, Hecla Quebec, 2018)

SUMMARY

On December 15, 2018, Emgold announced by press release that it had completed an assignment agreement with a third party, a privately held company, granting Emgold its rights, held through a binding Letter of Intent (“LOI”) with Greg Exploration Inc. and Affiliates (the “Vendors”), to acquire up to a 91% interest in the Casa South Property, Quebec (the “Property”), as more fully described below. On June 13, 2019, Emgold announced it has amended its agreement with the Vendors to acquire a 100% interest in the Property, which was completed on July 17, 2019.

The Property comprises 180 active mining titles covering a total of 10,061 hectares (100 square kilometers). It extends immediately south of Hecla Mining Corporation’s Casa Berardi Mine operation and extends laterally for 20 kilometers covering different sub-parallel structures corresponding to a distinct geophysical signatures and hosting elevated gold values in soil anomalies.

Casa Berardi Mine has produced approximately 2.5 million recovered gold ounces since commencing production in 1988 to the end of 2018 at an average grade of 6.58 g/t gold (source: Hecla 2018 Technical Report). Note that the presence of mineral resources and reserves found on the Casa Berardi Mine Property do not guarantee discovery or delineation of mineral resources and reserves on the Casa South Property.

LOCATION AND OWNERSHIP

The Property is located approximately 80 kilometers north of the town of La Sarre, Quebec or 105 kilometers west south-west of Matagami in the Casa Berardi township, James Bay Municipality. It is located south of the Casa Berardi Mine, owned and operated by Hecla Mining Corporation. It is accessible going north from La Sarre via Casa Berardi Mine’s all season gravel road. The Property consists of 180 active mining titles covering a total of 10,061 hectares. The claims are in one contiguous block.

Terms of the Assignment Agreement

Pursuant to the Assignment Agreement, Emgold has agreed to acquire the rights, held through the LOI executed between the Assignor and the Vendors, in exchange for 2,000,000 common shares of the Company (the “Shares”) to be issued to the Assignor, granting Emgold the option to acquire up to a 91% interest in the Property. The Shares to be issued to the Assignor will be subject to a minimum statutory hold period of 4 months from the date of issue.

Terms of the Letter of Intent

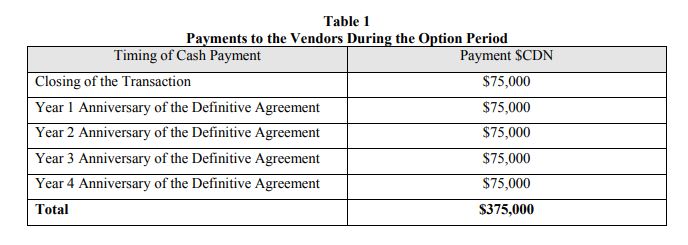

Emergent's assumption of the rights held through a LOI with a third party allowed Emgold the option to acquire up to a 91% interest in the Property under the following terms. During the option period (the “Option Period”), Emgold was required to make cash payments to the Vendors as shown in Table 1.

Emgold was required to complete $600,000 in exploration expenditures (“Exploration Expenditures”) in Year One of the Option Period. Emgold was required to make an additional $1,000,000 in Exploration Expenditures during the course of the Definitive Agreement, without any commitment as to amount and timing of amount to be spent. Exploration Expenditures included, but were not be limited to, cash payments made to the Vendors, claim fees, property taxes, exploration expenditures, permitting expenditures, reclamation expenditures, payments made to First Nations, holding costs, legal costs, and reasonable administrative costs. Excess expenditures, made in a given year, would be credited to future years of exploration of the Property.

If Emgold completed the contemplated $1.6 million in Exploration Expenditures during the Option Period, it would be entitled to a 91% interest in the Property. If Emgold completed $1.1 million but less than $1.6 million in Exploration Expenditures during the Option Period, it would be entitled to an 86% interest in the Property. If Emgold completed more than $600,000 but less than $1.1 million in Exploration Expenditures during the Option Period, it would be entitled to an 81% interest in the Property.

Emgold would have the right to accelerate the exercise of the Option and consequently reduce the Option Period by concurrently accelerating the aforementioned cash payments to Vendors and Exploration Expenditures. Should Emgold decide to accelerate such cash payments and Exploration Expenditures, Emgold would be entitled to a 20% discount on the contemplated annual cash payments to be made, as described hereinabove.

Once the conditions of the Option have been satisfied, Emgold and Vendors would form a joint venture with Emgold acting as the Manager and an industry standard joint venture agreement will be completed (the “Joint Venture”). As soon as reasonably practicable after the establishment of the Joint Venture, the claims comprising the Property would be transferred into the name of the Joint Venture.

Once the Option is completed, Emgold would grant to the Vendors a 1.5% Net Smelter Royalty (“NSR”) on the Property, being agreed that half a percent (0.5%) of said NSR can be repurchased by the Company for an amount of five hundred thousand dollars ($500,000).

On June 13, 2019, Emgold announced that it had completed amendment with the Vendors to the Definitive Agreement allowing it the option to acquire a 100% interest in the Property. The Company also it announced it was exercising that option. Under the terms of the Amendment, in lieu of the remaining payments and work commitments and in order to acquire a 100% undivided interest in the Property, Emgold had the option of issuing to the Vendors an amount of 4,000,000 units from its share capital (the “Compensation Units”), each Compensation Unit being comprised of one common share (each a “Compensation Share”) and one half of one common share purchase warrant (each a “Compensation Warrant”), each whole Compensation Warrant entitling the holder to acquire one (1) common share in the share capital of Emgold (each a “Compensation Warrant Share”) at a price of $0.25 per Compensation Warrant Share for a period of twenty four (24) months from the date of issuance.

The Compensation Shares and Compensation Warrant Shares issued as part of the Amendment are subject to a Right of First Refusal (“ROFR”) provisions and limitation of monthly sales by the Vendors (the “Offered Shares”) in any given calendar month, subject to a 10 business day Notice Period (the “Notice Period”). During the Notice Period, Emgold shall have the right to identify one or several acquirers to purchase the Offered Shares, to which the Vendors shall sell all (but not less than all) of the Offered Shares at equal or superior terms, based on the prior 10 day volume weighted average price of Emgold’s common shares on the TSX Venture Exchange.

A one and a half percent (1.5%) Net Smelter Royalty (“NSR”) was granted to the Vendors on the Property, being agreed that half a percent (0.5%) of said NSR can be repurchased by Emgold for an amount of C$500,000.

On July 17, 2019, Emgold announced it had completed the transaction and acquired a 100% interest in Casa South.

GEOLOGY AND MINERALIZATION

The Property encompasses a lithologic context similar to the Cass Berardi deposit. Its exploration history followed the same stages of evolution over a period of time from the 1960 to 1990 where exploration focued sulfide rich polymetallic deposits similar to the Kidd Creek, Selbaie, or Mattagami deposits discovered in the northern part of the Abitibi belt. Exploration work on the claims was done by companies such as Newmont, Noranda, and Cambior, among others.

Following the discovery of gold close to the Casa Berardi fault in 1981, various geophysical surveys were done on the Property as well as soil and rock chip sampling and drilling looking for similar targets. The historical gold potential appears to be located inside the Kama faults and related anomalies corresponding to a three kilometer by two kilometer area where disseminated pyrite and arsenopyrite concentrations were found in carbonated andesite along flow contacts. Over a period of 45 years, about 23,000 meters of drilling was done on the Property in 47 drill holes. The Vendors have compiled a significant database of information and conducted recent geophysics work that will aid Emgold in its exploration efforts.

RESOURCES

The Casa South Property is an early stage exploration Property, and no NI 43-101 compliant resources exist at this time.

MINING

No mining activity has occurred on the Property to date. There are currently no mineral reserves.

METALLURGY

No metallurgical work has been done on the Property.

CONCLUSIONS

The Casa South Property is an early stage exploration property. It is located to the south of the producing Casa Berardi Mine and appears to have similar parallel structures to those found at Casa Berardi. Historic exploration work by others includes soil sampling, rock chip sampling, geophysics, and diamond drilling. Potential exists for discover of both structurally controlled gold deposits as well as sulphide rich polymetalic deposits.

QUALIFICATION

Technical information included on this web page has been reviewed and approved by Alain Moreau, P.Geo., a Qualified Person as defined by National Instrument 43-101.

REFERENCES

Technical Report for the Casa Berardi Mine, Northwestern Quebec, Canada, NI 43-101 Report, for Hecla Quebec, Archambault-Giroux, De Los Rios, Blier, Roy, and MacDonald, Effective Date December 31, 2018, Filed April 1, 2019

NI 43-101 Technical Report, Casa Sud Property NTS 32E06/32E11, Northwestern Quebec, for Emgold Mining Corporation and Greg Exploration, Demers and Theberge, March 8, 2019

Technical Report Document

DISCLAIMER

Readers are cautioned to review the Disclaimer Page on this website for qualifications that may be applicable to the information contained on this Project Page, including Forward Looking Statements.