Vancouver, British Columbia, June 15, 2023 – Emergent Metals Corp. (TSXV:EMR, OTC:EGMCF, FRA:EML, BSE:EML) (“Emergent” or the “Company”) is pleased to provide an update on activities related to several of the Company’s exploration properties and the results of its Annual General Meeting held on June 14, 2023. Details are summarized below:

Mindora (West Santa Fe) Property, NV

As announced on May 15, 2023, Emergent has signed a binding Term Sheet (“Term Sheet”) and plans to complete an Option to Purchase Agreement (“Agreement”) with Lahontan Gold Corp. (TSXV: LG) (“Lahontan”). Lahontan, subject to certain terms and conditions, will have the option (“Option”) to acquire a 100% interest in Emergent’s Mindora Property, NV by completing US$1.8 million in cash payments and US$1.4 million in work expenditures on the property (total US$3.2 million) over a seven-year period. Lahontan is renaming the property “West Santa Fe” due to its synergy with their flagship asset, the Santa Fe Mine, located just 10 mi (15 km) to the east. Lahontan and Emergent plan to complete the Agreement within 45 days of the signing of the Term Sheet.

On May 31, 2023, Lahontan announced the company had staked an additional 95 unpatented mineral claims to the northeast and abutting the existing Mindora/West Santa Fe claims. This brings the total size of the Mindora/West Santa Fe property to 242 unpatented claims totaling approximately 4,800 ac (2,000 ha). The property, located 20 mi (30 km) southeast of Hawthorne, hosts oxide gold-silver mineralization in a geologic setting similar to the nearby Santa Fe Mine. Historic exploration drilling on the property totals approximately 43,000 ft (13,000 m).

On June 13, 2023, Lahontan announced results from rock-chip sampling at Mindora/West Santa Fe as part of their due diligence. Six rock chip samples were taken with results ranging from 0.13 g/t to 13.54 g/t Au Eq. Four rock-chip samples from outcrop in the main Au and Ag mineralized zone ranged from 2.71 to 13.54 g/t Au Eq and averaged 7.30 g/t Au Eq. Lahontan geologists also completed detailed statistical analysis of historic soil geochemical data from Mindora/West Santa Fe, the results show a remarkable correlation with known mineralized areas and outline multiple targets for further exploration. Details of the sampling can be found under Lahontan’s corporate filings under www.sedar.com. Emergent’s geologists have not verified these results.

New York Canyon, NV

As announced on April 3, 2023, Kennecott Exploration Company (“KEX”), a subsidiary of Rio Tinto Group (LSE: RIO), mobilized and commenced drilling activities on the New York Canyon Property, NV. New York Canyon is subject to an Earn-In with Option to Joint Venture Agreement (the “Agreement”) between Emergent and KEX. KEX has options to earn up to a 75% interest in the property by completing up to US$22.5 million in exploration expenditures and has spent over US$5.24 million on the property as of year-end 2022.

New York Canyon is located 30 mi (48 km) east of Hawthorne, Nevada and directly south of and abutting Lahontan’s Santa Fe Mine. The property, subject to the Agreement, consists of 21 patented claims and 152 unpatented claims owned by Emergent and 265 unpatented claims owned by KEX., for a total of 21 patented claims and 417 unpatented claims (8,700 ac or 3,500 ha in size). The claims are located in two blocks, North and South (the “North Block “ and “South Block”). The North Block, subject to the Agreement, consists of 27 unpatented claims. The South Block, subject to the Agreement, consists of 21 patented claims and 390 unpatented claims.

The South Block hosts the Longshot Ridge, Copper Queen, and Champion copper porphyry and skarn exploration targets. The North Block hosts the newly discovered Emma copper porphyry and skarn exploration target (see January 26, 2023, news release for additional details).

KEX has staked an additional 257 unpatented claims around the North Block (the “North Buffer Claims”) and 110 unpatented claims around the South Block (the “South Buffer Claims”), for an additional 367 unpatented claims. These additional claims do not fall under the Agreement and are outside the Area of Influence that is part of the Agreement. This brings the total number of claims that make up the New York Canyon Property to 21 patented claims and 784 unpatented claims, or approximately 15,700 acres (6,350 ha).

As part of its 2023 exploration program, KEX planned to drill two diamond drill holes. One is located on the South Block of claims testing a potential extension of the Copper Queen prospect based on a geophysical anomaly identified in 2022. KEX also planned to drill a second diamond drill hole in the North Block of claims, targeting the Emma prospect, based on soil and rock chip sampling completed in 2022.

KEX completed a total of four diamond drill holes totaling 4,359.02 ft (1,238.63 m). In the South Block of claims, Hole NYCN0011 was drilled to a depth of 772.01 ft (235.31 m) and Hole NYCN0012 was drilled to a depth of 1,404.00 ft (427.94 m). In the North Block of claims, Hole EMMA0001 was drilled to a depth of 171.00 ft (52.12 m) and Hole EMMA0002 was drilled to a depth of 2,012.01 ft (613.26 m). Note EMMA0001, planned at a dip of 77 degrees was terminated by geologists in the field and replaced by EMMA0002, which as drilled at a shallower dip of 60 degrees to better intercept the Emma target.

Drill core was quick-logged in the field and sent to KEX’s core logging facility in Salt Lake City. Core is now being logged in detail and processed, after which samples will be sent to an independent laboratory for assaying. Additional details on the drill program, assay results, and QA/QC procedures will be provided in future press releases, likely within 60-90 days.

Golden Arrow Property, NV

Golden Arrow is located approximately 40 mi (64 km) east of Tonopah in Nye County, Nevada. The property consists of 494 unpatented and 17 patented lode mineral claims covering an area of approximately 10,000 ac acres (4,000 hectares). It is an advanced-stage exploration property with a comprehensive exploration database including geochemical sampling, geophysics, and over 201,000 feet of reverse circulation and diamond core drilling.

To date, two main exploration targets have been drilled on the property focusing on bulk disseminated mineralization which resulted in the delineation of the Gold Coin and Hidden Hill resource zones. Numerous other targets have been identified for exploration. Emergent’s management believes there is potential to expand both the Hidden Hill and Gold Coin resources and for discovery of other bulk disseminated mineralization on the property. In addition, historic underground mine workings lie along the Page Fault and other structures on the property indicating potential for vein style mineralization that has been subject to limited modern exploration to evaluate its potential.

A Technical Report, entitled “Amended 2018 Updated Technical Report on the Golden Arrow Project, Nye County, Nevada, U.S.A.” (the “Technical Report”) was prepared for Emergent by Mine Development Associates in Reno, Nevada, and has an effective date of August 28, 2018, and a report date of September 24, 2018. The Technical Report was prepared by qualified persons Steven Ristorcelli, CPG, Odin D. Christensen, PhD, CPG, and Jack S. McPartland, MMSA (collectively, the “Authors”), in support Emergent’s acquisition of the property. The Authors are independent of Emergent.

The Technical Report discloses a mineral resource, which particulars are set out in Table 1 below. The mineral resource was modeled for the Property and estimated by evaluating the drill data statistically and utilizing a three‐dimensional geological solid model. Mineral domains were interpreted on northeast‐southwest geological cross sections spaced at approximately 100-foot intervals throughout the extent of the Property mineralization. The mineral domain interpretations were then rectified to east‐west cross sections spaced at 20-foot intervals. Estimation was done by inverse‐distance. The Authors were certified to make their own independent investigations based on what they deemed necessary, in their professional judgment, to be able to reasonably rely on the provided information to make the conclusions and recommendations presented in the Technical Report.

Table 1

Golden Arrow Property Mineral Resource1,2,3,7,8

|

Classification |

Cut-Off Grade4,5 |

Tons |

Au opt |

Ag opt |

Au Ounces |

Ag Ounces |

|

Measured |

Variable |

1,850,000 |

0.028 |

0.43 |

52,400 |

796,000 |

|

Indicated |

Variable |

10,322,000 |

0.024 |

0.31 |

244,100 |

3,212,000 |

|

Measured and Indicated |

Variable |

12,172,000 |

0.024 |

0.33 |

296,500 |

4,008,000 |

|

Inferred6 |

Variable |

3,790,000 |

0.013 |

0.33 |

50,400 |

1,249,000 |

- CIM Standards were followed in reporting the mineral resource estimate.

- Effective date of the mineral resource is November 28, 2017.

- Any known legal, political, environmental, or other risks that could materially affect the potential development of the Mineral Reserves are detailed below in the section entitled “Cautionary Note Regarding Forward-Looking Statements”.

- Cut-off grades are 0.01 gold equivalent opt for oxide material and 0.015 gold equivalent opt for sulfide material. Mine Development Associated derived these cut-off grades using mining costs of US$2.00 per ton, heap-leach costs of US$4.00 per ton, milling costs of US$12.00 per ton, and G&A costs of US$3.50 per ton. Metallurgical recoveries were assumed to range from 70% to 95% for gold, depending upon the oxidation state and sulfide content of the material, and heap-leach or milling scenarios envisioned. Multiple economic evaluations were done including pit optimization that demonstrated the economic viability.

- Gold equivalent cut-off grade calculated using a 55:1 gold to silver price ratio. No adjustment was made for metallurgical recovery.

- The quality and grade of inferred resources are uncertain in nature and there has been insufficient exploration to define these inferred resources as measured or indicated resources and it is uncertain whether further exploration will result in upgrading them to measured or indicated resource categories.

- Mineral resources that are not mineral reserves do not have demonstrated economic viability.

- The Authors verified the data in the Technical Report through a combination of data audits, where drilling data compiled in the project database was compared to paper logs, maps, assay certificates and other records, and independent verification sampling. There have been no limitations on, or failure to conduct the verification.

As outlined in the Technical Report, the Authors determined that the Golden Arrow is a property of merit that warrants continued exploration and recommend that Emergent undertake continued systematic exploration to discover additional centers of mineralization within the property.

On January 12, 2021, Emergent expanded the Golden Arrow Property to the south by staking an additional 137 unpatented claims to bring the property to its current size. As reported on November 23, 2021, the Company completed:

- An airborne-radiometric survey over the new claim area using Precision GeoSurveys Inc.

- An induced polarization and resistivity ground geophysical survey over the new claim area using Zonge International Inc.

- Updated the Company’s 3-D geological model over the known resource areas using Hexagon HxGN MinePlan 3-D software.

- Re-processed and reanalyzed historic and recent geophysics work over the entire property, conducted by Condor Consulting Inc. (“Condor”).

- Correlated magnetic susceptibilities of lithologic units to geophysical signatures.

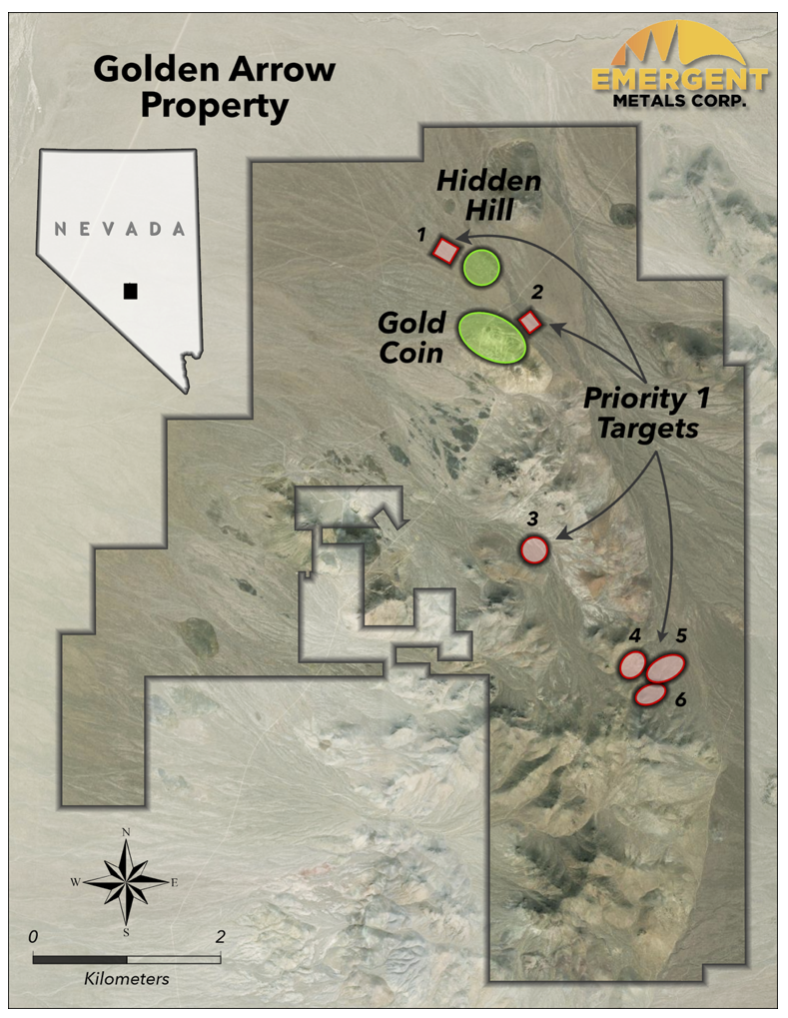

Thirty-four new exploration targets were identified by Condor, with six assigned a high priority designation, as shown in Figure 1 below, and 10 assigned a medium priority designation. Two of these high priority targets are in the vicinity of the current resources and four are to the south on the new claims staked by the Company.

Figure 1

Figure 1

Golden Arrow Property Showing Hidden Hill and Gold Coin Deposits.

Six New High Priority Geophysical Exploration Targets

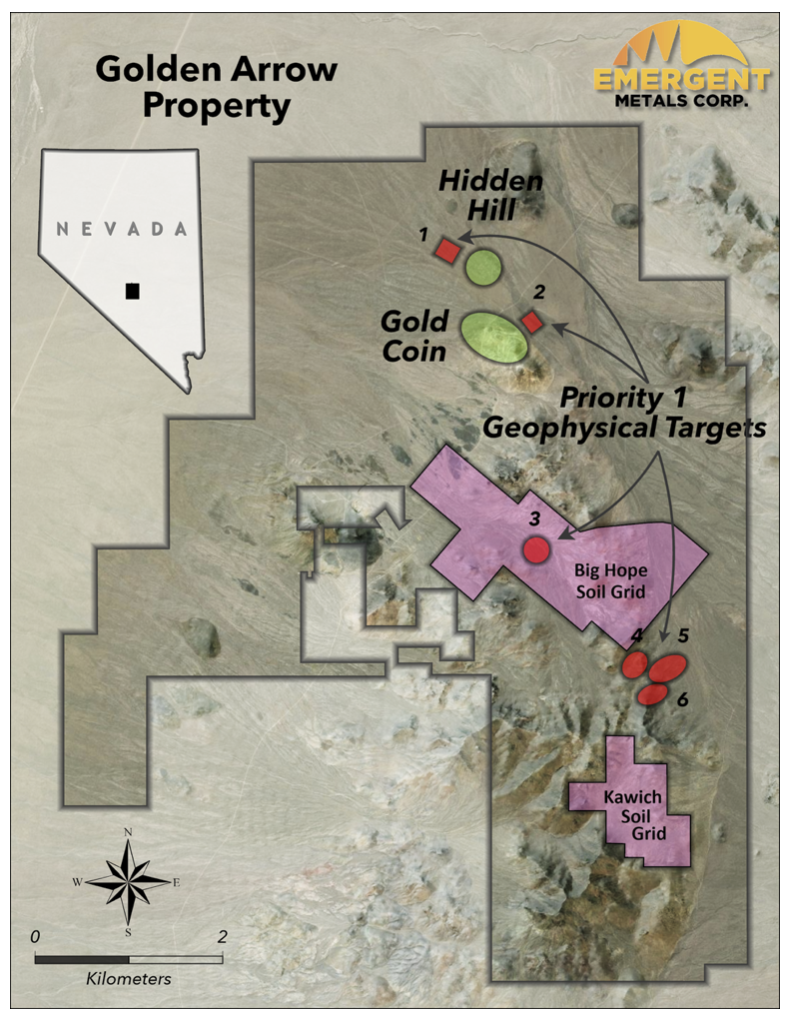

On December 31, 2021, Emergent reported results from soil sampling at Golden Arrow conducted by Rangefront Mining Services. The soil sampling was completed in parallel to the geophysics work outlined above and the sampling locations were not based on geophysical targets but were based on rock chip sampling results along mineralized structures associated with Walker Lane faulting along the western edge of the Kawich Caldera. The location of the soil sampling grids is shown in Figure 2 below.

Two exploration targets were defined by the soil sampling, named the Big Hope and Kawich Targets. The Big Hope Target coincides with high priority geophysical anomaly 3. The Big Hope Target is just to the north and the Kawich Target is just to the south of high priority geophysical anomalies 4, 5, and 6. It coincides with a medium priority geophysical target identified by Condor. Hence, additional soil sampling needs to be completed between the Big Hope and Kawich Targets to close the gap between the two targets to better understand if there are multiple smaller targets or one large target.

The Golden Arrow Property has a Plan of Operations and Environmental Assessment completed that allows a major drilling program in the known resource areas of Gold Coin and Hidden Hill. Additional permitting would be required to drill the new targets on the new claims to the south.

Figure 2

Figure 2

Golden Arrow Property Showing Hidden Hill and Gold Coin Deposits.

Six New High Priority Geophysical Exploration Targets

And Two Soil Sampling Targets

Emergent management believes the Golden Arrow Property has potential to host measured and indicated mineral resources of 0.5 to 1.0 million Au Eq. ounces, at a grade of 0.02-0.03 opt Au and 0.3 to 0.4 opt Ag. This is based on expanding the Gold Coin and Hidden Hill resource areas laterally and at depth. The potential also exists to further expand these resources with delineation of new resources in the recently discovered satellite exploration targets, including Big Hope, Kawich, and others. Expansion of resources is subject to exploration success and other factors.

Emergent is evaluating its next steps for Golden Arrow, which could include drilling to expand resources followed by an updated Technical Report or Preliminary Economic Assessment. This would be subject to financing. Alternatively, Emergent would like to find an operating or other partner to advance the property.

Trecesson Property, QC

On April 17, 2023, Emergent announced results from a Phase 1 drill program at its Trecesson Property in Quebec. Trecesson is a 5,800 ac (2,400 ha) property located 8 mi (13 km) west of the town of Amos, in the Abitibi Region of Quebec. It is just about 50 mi (80 km) north of the Val d’Or mining camp. The Program consisted of 17 NQ size core holes totaling 7,706 ft (2,349 m) of drilling, focused on testing the Cossette North and South vein systems. The most significant intercept was found in hole TR-23-03 where grades averaged 19.96 g/t Au and 5.13 g/t Ag over 1.1 m (0.64 oz/st Au and 0.16 oz/st Ag over 3.61 ft) in length. This value corresponds to one of the intersections where visible gold was logged by geologists, as announced by the Company in a January 31, 2023, press release.

Emergent has retained Mercator Geological Services (“Mercator”) to complete a Prospectivity Mapping Study of the Trecesson claim area. Mercator has also been retained to complete a NI 43-101 Technical Report on the property. Work on both these items is ongoing. Based on the results of these reports and subject to financing, Emergent plans to conduct permit and conduct a Phase 2 drill program at Trecesson later this year.

Casa South, QC

Emergent’s Casa South Property, Quebec, is located directly south of and abutting Hecla Mining Corporation’s (NYSE:HL) Casa Berardi Mine and consists of 204 mineral claims totaling 28,200 ac (11,400 ha). Note that the vicinity of Casa South to Casa Berardi Mine does not guarantee exploration success at Casa South. No mineral resources or reserves had yet been delineated on the Casa South Property.

As announced on September 1, 2021, Emergent completed a UAV-MAGTM magnetic survey of the Casa South Property. Geokincern Limited (“Geokincern”) subsequently completed an interpretive exploration model of the property taking into account geology, geophysical, and structural data including use of the magnetic survey, high-resolution topographic data from NASA’s Suttle Radar Topography mission, and satellite imagery. Geokincern identified 20 geophysical targets for follow up (G1 – G20).

As announced on December 8, 2022, the also Company retained Mercator to complete modelling and interpretation of 197 historic reverse circulation (“RC”) drill holes completed to sample glacial till on the property by Overburden Drilling Management (“ODM”) in 1989. These RC holes were drilled with the goal of tracing any metal anomalies in the till back to their bedrock source of metals. This is a method that was used to help discover the Casa Berardi deposit, to the north of Casa South, in the 1980’s. This analysis identified 14 additional drill targets for future exploration (M1-M14).

On December 8, 2022, Emergent announced it had completed ten diamond core drill holes totaling 9,721 ft (2,963 m) as a first phase (“Phase 1”) of a drilling program (the “Program”) at its Casa South. Five of the 20 Geokincern targets were tested by this program (G1, G2, G3, G4, and G7). Anomalous gold values were found in the Kama Trend, a 4.3 mi (7.0 km) by 1.2 mi (2.0 km) wide east-west trending structure paralleling the Casa Berardi Deformation Corridor to the north.

Emergent has retained Mercator to complete a Prospectivity Mapping Study of the Casa South claim area. Mercator has also been retained to complete an updated NI 43-101 Technical Report on the property. Work on both these items is nearing completion. Based on the results and work completed by both Geokincern and Mercator, Emergent plans to identify and prioritize targets for additional drilling on the property. Emergent plans permit a Phase 2 drilling program at Casa South, with timing of the drill program to be determined in the future and dependent on financing.

Corporate Update – AGM Results

Emergent is pleased to announce the results of its Annual General Meeting (“AGM”) held on June 14, 2023. All resolutions presented to the shareholders were approved (please refer to the SEDAR filing of the Company’s Information Circular dated May 10,2023). As a result, the number of Directors was set at five with the following nominees elected as Directors: David Watkinson, Robert Rosner, Andrew MacRitchie, Vincent Garibaldi, and Julien Davy. MNP LLP, Chartered Professional Accountants, were re-appointed as the auditor of the Company. The Company’s new Incentive Stock Option Plan was approved, and shareholders also approved the grant of 1,300,000 incentive stock options (see January 4, 2023, press release for details).

Qualified Person

All scientific and technical information disclosed in this new release was reviewed and approved by Robert Pease, CPG, a consultant to Emergent and a non-independent qualified person under National Instrument 43-101. Mr. Pease is a consultant to the Company.

About Emergent

Emergent is a gold and base metal exploration company focused on Nevada and Quebec. The Company’s strategy is to look for quality acquisitions, add value to these assets through exploration, and monetize them through sale, joint ventures, option, royalty, and other transactions to create value for our shareholders (acquisition and divestiture (A&D) business model).

In Nevada, Emergent’s Golden Arrow Property, the core asset of the Company, is an advanced stage gold and silver property with a well-defined measured and indicated resource. New York Canyon is a base metal property subject to an Earn-in with Option to Joint Venture Agreement with Kennecott Exploration, a subsidiary of Rio Tinto Plc (LSE:RIO). The Mindora Property is a gold, silver, and base metal property located twelve miles from New York Canyon. Buckskin Rawhide East is a gold and silver property leased to Rawhide Mining LLC, operators of the adjacent Rawhide Mine.

In Quebec, the Casa South Property, is an early-stage gold property adjacent to Hecla Mining Corporation’s (NYSE:HL) operating Casa Berardi Mine. The Trecesson Property is located about 50 km north of the Val d’Or mining camp. Emergent has a 1% NSR in the Troilus North Property, part of the Troilus Mine Property being explored by Troilus Gold Corporation (TSX:TLG). Emergent also has a 1% NSR in the East-West Property, owned by O3 Mining Corporation (TSX:OIII) and adjacent to their Marban Property.

Note that the location of Emergent’s properties adjacent to producing or past producing mines does not guarantee exploration success at Emergent’s properties or that mineral resources or reserves will be delineated.

For more information on the Company, investors should review the Company’s website at www.emergentmetals.com or view the Company’s filings available at www.sedar.com.

On behalf of the Board of Directors

David G. Watkinson, P.Eng.

President & CEO

For further information, please contact:

David G. Watkinson, P.Eng.

Tel: 530-271-0679 Ext 101

Email: [email protected]

Neither TSX Venture Exchange nor its Regulation Services Provider (as the term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note on Forward-Looking Statements

Certain statements made and information contained herein may constitute “forward looking information” and “forward looking statements” within the meaning of applicable Canadian and United States securities legislation. These statements and information are based on facts currently available to the Company and there is no assurance that actual results will meet management’s expectations. Forward-looking statements and information may be identified by such terms as “anticipates”, “believes”, “targets”, “estimates”, “plans”, “expects”, “may”, “will”, “could” or “would”. Forward-looking statements and information contained herein are based on certain factors and assumptions regarding, among other things, the estimation of mineral resources and reserves, the realization of resource and reserve estimates, metal prices, taxation, the estimation, timing and amount of future exploration and development, capital and operating costs, the availability of financing, the receipt of regulatory approvals, environmental risks, title disputes and other matters. While the Company considers its assumptions to be reasonable as of the date hereof, forward-looking statements and information are not guarantees of future performance and readers should not place undue importance on such statements as actual events and results may differ materially from those described herein. The Company does not undertake to update any forward-looking statements or information except as may be required by applicable securities laws. The Company’s Canadian public disclosure filings may be accessed via www.sedar.com and readers are urged to review these materials, including any technical reports filed with respect to the Company’s mineral properties.